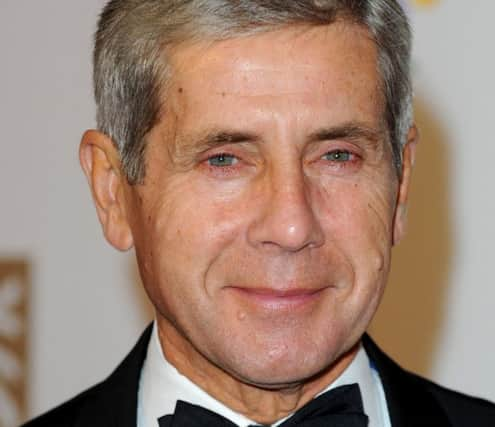

Zenith appoints Lord Rose as chairman

Lord Rose has more than 40 years’ experience in the consumer and retail sectors during which time he served as chief executive at Argos plc, Booker plc, Arcadia Group plc and Marks & Spencer plc.

He was chairman of Marks & Spencer plc from 2008 to 2011. He was knighted in 2008 for services to the retail industry and corporate social responsibility, and granted a life peerage in August 2014.

Advertisement

Hide AdAdvertisement

Hide AdAmong his current business interests, he is chairman of Ocado, the online supermarket and of the active lifestyle retailer Fat Face. He is a non-executive director of Woolworths Holdings in South Africa. He is also a member of Bridgepoint’s Advisory Board.

Welcoming Lord Rose to the board, Tim Buchan, chief executive officer of Zenith, said: “I’m delighted that Stuart is joining Zenith as our chairman. He’s had a fantastic business career and has unparalleled experience in understanding the consumer, all of which will be important to the future development of our company.”

Lord Rose said: “I am impressed by Zenith’s growth story: the UK fleet services market is a large, growing and resilient market so we will all have even more to go for. I very much look forward to working with the team.”

Established in 1989 and headquartered in Leeds, Zenith focuses on both the corporate car and consumer markets with services that range from funding company cars or commercial vehicles and providing flexible employee benefit schemes to delivering fully outsourced fleet management services. It also provides ‘white label’ back office fleet management systems and services to vehicle manufacturers and financial services businesses.

Zenith was acquired in 2017 by the European private equity group Bridgepoint in a transaction totalling £750 million.