Happy new year for region’s top firms as they beat FTSE

Brewin Dolphin, which charts Yorkshire’s 50 biggest plcs, said the YPQuoted Index of shares made a capital return of over 30 per cent last year, soundly beating the FTSE All Share Index’s 17 per cent increase.

Of the 50 stocks in the YPQuoted Index, 41 posted positive returns with just nine posting negative returns.

Advertisement

Hide AdAdvertisement

Hide AdBrewin’s divisional director, Matthew Wells, said: “Yorkshire plc performed very well in 2013.

“The small/medium cap recovery has come through. We think the UK domestic economy will go from strength to strength in 2014 and Yorkshire plc is well placed to benefit.”

He added that the YPQuoted Index benefits from having a high proportion of smaller sized companies in the portfolio as smaller companies outperformed during 2013.

“Coming out of the credit crunch, everyone hunkered down to quality blue chip stocks,” he said.

Advertisement

Hide AdAdvertisement

Hide Ad“As people are willing to take on more risk, they are moving up the risk scale. That puts these Yorkshire companies on people’s investment lists and we’re seeing increased demand for the region’s shares.”

As with the FTSE stock indices, companies that saw a fall in market capitalisation were replaced by better performing YPQuoted Index companies.

This meant that Rotherham-based butchery chain Crawshaw entered the index for the first time this year.

The group enjoyed an astonishing 477 per cent increase in its share price in 2013, which would have put it top of the leader board if it had been included in the index in 2013. Crawshaw reported a sharp rise in Christmas sales yesterday.

Advertisement

Hide AdAdvertisement

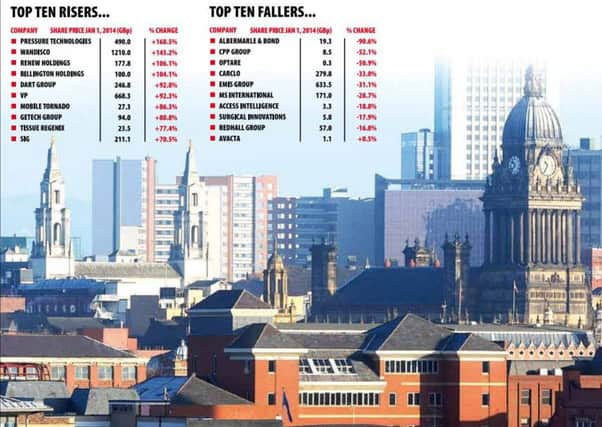

Hide AdInstead the accolade of Yorkshire’s top performer went to Sheffield-based engineer Pressure Technologies, which enjoyed a 169 per cent increase in share price in 2013.

The group, which reported record annual results last year, counts the Royal Navy and the US Air Force among its customers. The company makes gas cylinders for oil rigs and a range of equipment for use on submarines.

The second best performer was high-flying Sheffield-based software firm WANdisco, which saw a 154 per cent increase.

The company specialises in software that allows its customers, which include Nokia, Sony, Apple, Barclays, Honda and Asda’s parent company Wal-Mart, to store and share huge amounts of data.

Advertisement

Hide AdAdvertisement

Hide AdThe third best performer was Leeds-based engineer Renew Holdings, which enjoyed a 106 per cent increase in share price.

Renew reported record annual results in 2013 and set itself the ambitious target of becoming a £500m turnover company within the next three years.

The group counts Sellafield nuclear plant, Northumbrian Water and Network Rail among its biggest clients.

In fourth place came Barnsley-based structural steel group Billington Holdings, which saw a 104 per cent rise in its shares.

Advertisement

Hide AdAdvertisement

Hide AdThe group announced a return to profit last September as its focus on new sectors such as rail and energy started to pay off.

Dart Group, the Leeds-Bradford airport-based owner of Jet2.Com and Jet2holidays, took fifth place, following a 93 per cent rise in share price.

Jet2holidays grew customer numbers by 103 per cent to 634,866 in the six months to September 30 while the leisure airline, Jet2.Com, saw passenger numbers increase by 13 per cent to 4.1m.

In sixth place was Harrogate-based equipment hire firm Vp, which rose 92 per cent. The group reported a leap in profits last year and a notable improvement in the residential and infrastructure sectors.

Advertisement

Hide AdAdvertisement

Hide AdIn seventh place was Mobile Tornado, the Harrogate-based company that can turn mobile phones into walkie-talkies, enabling people to connect in less than one second wherever they are.

Mobile Tornado saw an 86 per cent increase in share price.

In eighth place was Leeds-based oil data firm Getech, which saw an 81 per cent increase.

The group, which maps out areas around the world where oil may be found, announced an 80 per cent leap in annual pre-tax profits last year.

In ninth and tenth places were York-based Tissue Regenix, which uses animal and human tissue to replace damaged human body parts, and Sheffield-based insulation firm SIG.

Advertisement

Hide AdAdvertisement

Hide AdMr Wells said stocks exposed to housebuilding and construction also fared particularly well with the likes of Huddersfield-based Marshalls (+70.3 per cent) and Persimmon (+46.9 per cent) making stellar gains.

Technology stocks performed well on a global basis and both Saltaire-based Pace and Leeds-based Filtronic posted very strong gains over the year of 67.2 per cent and 51.7 per cent respect- ively.

But there were losers...

YORKSHIRE’s biggest loser was struggling pawnbroker Albemarle & Bond which saw a 91 per cent decline in share price.

The group, which includes Leeds-based Herbert Brown, was dealt a blow after a potential buyer walked away last month.

Advertisement

Hide AdAdvertisement

Hide AdThe second biggest loser was troubled York-based credit card insurance firm CPP which was embroiled in the mis-selling scandal. Its shares lost 52 per cent. In third was Sherburn in Elmet-based bus maker Optare which saw a slump in demand leading to a 51 per cent decline.

Fourth was Ossett-based touchscreen sensor developer Carclo, which suffered order delays leading to a 33 per cent fall.