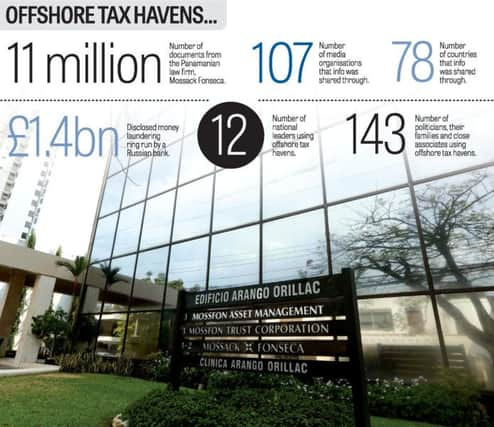

Infographic: Whose names are leaked in Panama tax papers?

The financial affairs of the rich and powerful have been laid bare as 12 million documents were thrust into the hands of journalists around the world by offshore law company Mossack Fonesc, in Panama.

Six peers, three Tory ex-MPs and “dozens” of UK political party donors - whose names have not been released - are reported to have been clients of the firm and thus screening their wealth from Her Majesty’s Revenue & Customs (HMRC).

Advertisement

Hide AdAdvertisement

Hide AdThey include Ian Cameron, the Prime Minister’s father who died in 2010, along with Baroness Sharples, and former Tory MP Michael Mates.

Internationally, the Icelandic Prime Minister Sigmundur Gunnlaugsson is facing calls for his resignation over his name appearing in the files over an undeclared interest in the country’s bailed-out banks and the Kremlin has branded the allegation that associates of the Russian President Vladmir Putin are involved in a £1.4bn money laundering ring as a ‘smear’.

Mr Cameron’s father’s links to Panama have surfaced again during the leak, however details of his will released in 2012 showed at that point he was a director of Blairmore Holdings Inc which was registered in Panama City and had been legally exempt from UK tax.

The Prime Minister’s spokeswoman said the late Mr Cameron’s tax arrangements had been covered extensively by the press in 2012 and Downing Street had responded at the time and had nothing else to add.

Advertisement

Hide AdAdvertisement

Hide AdIn terms of family money potentially still in the Panamanian fund, she said it was a ‘private matter’.

She added that the Government has acted to tackle tax evasion and avoidance and aggressive tax planning and in December ministers from crown dependencies and overseas territories agreed to keep registers that show a company’s beneficial ownership details. Ensuring tax is paid properly to HMRC has been on the Government’s agenda since 2014 and denied work to clamp down on tax avoidance was taking too long.

She said: “HMRC is already carrying out an intensive investigation of offshore companies, including in Panama and clearly this data may be able to assist with that.

“The Prime Minister put this front and centre of our G8 presidency and led global efforts to improve action on tax and transparency so we have now secured 90 countries signed up to the automatic exchange of information in this area. We proposed and secured G20 and OECD for a common reporting standard for people to use and we continue to work with the crown dependencies and overseas territories to see that they fulfil the commitments that we’ve made.”

Advertisement

Hide AdAdvertisement

Hide AdShe said efforts from countries to stick to a register will be reviewed and if they do not comply she said the Prime Minister ‘rules absolutely nothing out’ in terms of action they are prepared to take.

The Public and Commercial Services union general secretary Mark Serwotka said: “We are supporting shadow chancellor John McDonnell’s root-and-branch review of HMRC to ensure the department has the resources it needs to collect the taxes that fund the public services we all rely on.”