London ‘a city of barristers and baristas and no-one in the middle’, says Lanchester

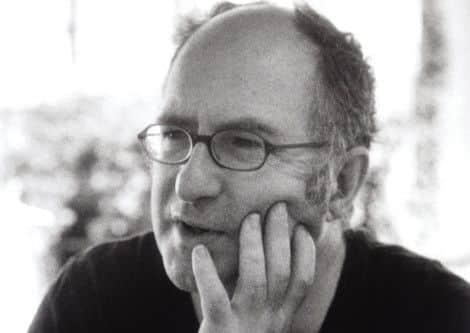

John Lanchester is the author of Capital, a best-selling novel set in London during the financial crisis as well as Whoops! Why Everyone Owes Everyone and No One Can Pay, a well-received work of non-fiction about the causes of the credit crunch.

He will be appearing at the Ilkley Literature Festival next month to speak about his new book, How to Speak Money, which is designed to decode the language of the economic elites.

Advertisement

Hide AdAdvertisement

Hide AdIn an interview with The Yorkshire Post, Mr Lanchester said money has had many positive effects on London, where he has lived for 25 years, by making it “more energetic, more vibrant, more diverse and more colourful”.

“But I think the trends are worrying because we are heading towards a city of barristers and baristas and no-one in the middle. It is being hollowed out.

“It is a great city for the rich but it is becoming a less good city for everyone else. It is sucking too much out of the rest of the country.

“There are quite a few ways that London has a negative impact on Britain just by being too big.”

Advertisement

Hide AdAdvertisement

Hide AdHe said the detachment of financial services and the capital from the rest of the country should not be allowed to continue.

Mr Lanchester added: “We can’t have London as a separate city state and a place that when the rest of Britain looks at London they don’t recognise it.

“That’s a strange thing for people to look at the capital city and not recognise themselves. I do think that’s a very powerful factor in the independence thing.”

He lives in Clapham, a well-heeled part of South London, but said he did not spend too much time thinking how much the price of his house has risen.

Advertisement

Hide AdAdvertisement

Hide AdMr Lanchester said: “For me, there’s something a bit mad about the way that people treat their house as if it’s chip on a casino table.

“We have lived in the same house for 20 years. Obviously it has gone up in value but it doesn’t get in my head much because we are not planning to move.

“If we were going to sell up and go and live in a farm in Argentina no doubt we would be able to buy quite a nice one but I’m not planning to do that.”

His 2012 novel Capital focuses on the inhabitants of Pepys Road, a fictional street in South London that becomes a haven for the rich following exorbitant house price inflation.

Advertisement

Hide AdAdvertisement

Hide AdHe said his latest book, How to Speak Money, is about the language of finance, “the importance of democratising it and why people should get hold of it”, Britain’s place in relation to the rest of world and how it responds to slowing growth and rising inequality.

Asked about his own reading habits, Mr Lanchester praised books by French economist Thomas Piketty, Financial Times columnist Tim Harford and Cambridge University academic Ha-Joon Chang.

* John Lanchester will be appearing at the Ilkley Literature Festival on October 19.

Lexicon is top-of-the-range bluffer’s guide

From A and B shares, AAA-rated debt and Abenomics to zero-hour contracts, ZIRP (zero interest rate policy) and zombie banks, John Lanchester’s new book promises to enlighten readers about the lexicon of money.

Advertisement

Hide AdAdvertisement

Hide AdLarry Elliott, economics editor at The Guardian, describes How to Speak Money as “a Bluffer’s Guide, albeit a top-of-the-range job”.

In his review, Mr Elliott writes: “In truth, there is more to the power of finance than its use of obfuscatory language.

“The global banks are now so big and interlocked that breaking them would be hard to do even if politicians had the will.”