Man who bought BHS: '˜A Premier League liar with his fingers in the till'

The chain’s chief executive Darren Topp alleged that Dominic Chappell issued the death threat when he questioned him over a £1.5 million transfer of BHS money to Sweden.

“If you kick off about it, I’ll come down there and kill you,” Mr Topp claimed Mr Chappell told him.

Advertisement

Hide AdAdvertisement

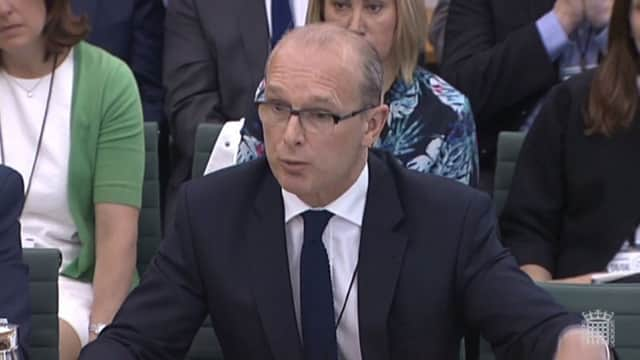

Hide AdThe explosive claims were made during heated exchanges in front of the Commons Business and Pensions Committees, which are investigating events surrounding the retailer’s collapse.

MPs also heard that twice-bankrupt Mr Chappell was a “mythomaniac”, a “premier league liar” and a “Sunday pub league retailer”, according to former BHS finance consultant Michael Hitchcock.

Mr Topp added that Mr Chappell’s assurances on buying BHS “unravelled and, rather than putting money in, he had his fingers in the till”.

He claimed Mr Chappell received a £1.8 million payment from the sale of BHS and £7 million from the sale of the retailer’s offices.

Advertisement

Hide AdAdvertisement

Hide AdMr Hitchcock said he was forced to change the company’s bank mandate to “stop any chance of money flowing outside of the business”.

However, Mr Chappell chose instead to focus on the role of Sir Philip in the saga, claiming that the Topshop billionaire blocked a rescue attempt from Sports Direct boss Mike Ashley and tipped BHS into administration.

“Mike Ashley was going to save the business, but Sir Philip Green was screaming down the phone, saying he didn’t want to get involved with Mike Ashley,” he said.

He claimed that on hearing of the potential deal, Sir Philip called in a £35 million loan held by his Arcadia group, pushing BHS into administration.

Advertisement

Hide AdAdvertisement

Hide AdMr Chappell claimed he did everything in his power to save the firm, including offering Mr Ashley his shares, but his attempts were “rail-roaded” by Sir Philip.

Last week, administrators to the department store chain called time on trying to find a buyer, resulting in the loss of up to 11,000 jobs and leaving behind a £571 million pensions black hole.

Mr Chappell said that Sir Philip effectively continued to run BHS even after the sale in March 2015 and that the retailer was “saveable”.

“I think our company was saveable and I think, had Sir Philip assisted us, we could have saved BHS. We were in the throes of beginning a turnaround proper after a very successful property CVA and we were moving forward,” he said.

Advertisement

Hide AdAdvertisement

Hide AdHe claimed that because of Arcadia’s position as a secured creditor it was ultimately Sir Philip who took the decision to put BHS into administration. He also accused administrator Duff & Phelps of being “heavily conflicted” because of its close connection with Sir Philip, describing the firm as the billionaire’s “pony”.

Asked whether he thought Sir Philip was a successful retailer, Mr Chappell said he had been very successful at raising “a lot of money from businesses and taking huge sums out of them”, an apparent reference to a £400 million dividend paid to the billionaire’s family from BHS.

He also said he is looking at launching a legal suit against Arcadia and Sir Philip over a BHS property sale by the tycoon to his stepson. He claimed that BHS missed out on £3.5 million because of it.

Asked if he had profited out of his ownership of BHS, Mr Chappell said: “Yes, I have made a profit out of this, but I racked up considerable fees.”

Advertisement

Hide AdAdvertisement

Hide AdHe admitted he was in the Bahamas when administrators were called in to BHS, although he claimed he was there on business before having an eye operation.

He concluded by offering an apology for the chain’s collapse, adding: “I am very upset that there are 11,000 people directly and a number of thousand indirectly who have lost their jobs. It’s a travesty that that has happened. That is an apology.

“As a majority shareholder I must stand forward and say we were part of the downfall of BHS.”

Attention will now turn to Sir Philip’s appearance in front of the committee, on June 15.