Merlin casts its magic as shares take off on stock market debut

Merlin, which closed the offering early due to strong demand, said 87.5 per cent of the sale had gone to institutional investors such as pension funds.

Following the success of the Royal Mail share offer, retail investors took the other 12.5 per cent of the shares in the market’s latest high-profile flotation.

Advertisement

Hide AdAdvertisement

Hide AdPrivate investors who applied for the minimum £1,000 received all they applied for.

People who wanted more were given £1,000 worth of shares (317 shares each) and 55 per cent of the remaining amount they applied for up to a maximum of 8,872 shares.

New shareholders will be entitled to a 30 per cent discount on two adult Merlin annual passes or one family Merlin annual pass.

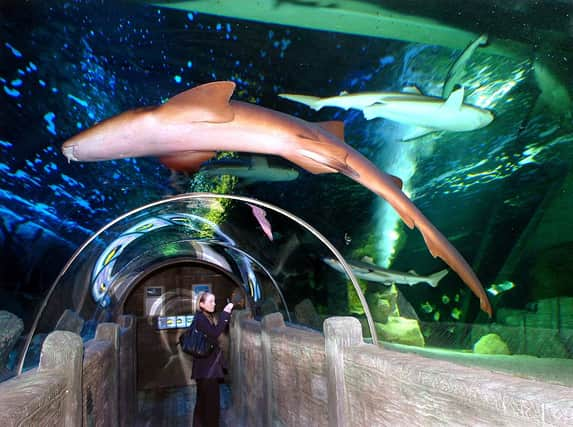

Following the leap in share price the firm, which also owns Madame Tussauds, the London Eye and Alton Towers, is valued at around £3.5bn.

Advertisement

Hide AdAdvertisement

Hide AdThe shares opened up 3.2 per cent at 325p and hit a high of 355p before settling back to close the day at 347p.

The private equity-backed company, the world’s second-largest visitor attraction firm behind Walt Disney Co, originally set a range of 280p to 330p per share.

Private equity owners Blackstone and CVC sold a chunk of their shares, as did Kirkbi, the Danish family-owned investment company which owns the Lego and Legoland trademarks and 75 per cent of the Lego Group.

Kirkbi has retained a significant shareholding, with a stake of just under 30 per cent, while Blackstone held 22.6 per cent and CVC owned 13.1 per cent at the start of trading yesterday.

Unconditional dealings will begin on Wednesday.

Advertisement

Hide AdAdvertisement

Hide AdThe offer of 30 per cent of Merlin’s shares raised an initial £957m for the company and its selling shareholders. Shares began trading at 315p.

It is understood that the sale of the 30 per cent stake was nine times oversubscribed at the offer price.

The company made £165m from the sale, which will go towards reducing debt.

Merlin, which operates 99 attractions in 22 countries and drew 54 million visitors last year, is the latest high-profile firm to list on the London market, following recent debuts by Royal Mail and estate agency chain Foxtons.

Advertisement

Hide AdAdvertisement

Hide AdYorkshire’s IPO scene has also been hotting up recently with Premier Technical Services Group (PTSG), a Leeds-based equipment services specialist, the latest business to signal its intention to float.

PTSG’s chief executive Paul Teasdale said: “Hopefully, the future for us is becoming a public company early next year.

“I think the company will become somewhere between £50m and £100m turnover over the next few years. We employ 137 people, a good percentage come from Yorkshire. We expect to double that in the next five years.

“The services sector and the construction index is rising.”

The group specialises in providing services for people working at height.

Advertisement

Hide AdAdvertisement

Hide AdRichard Naish, a corporate partner at Yorkshire law firm Walker Morris, expects to see more initial public offerings from Yorkshire companies in the coming year.

He is advising Servelec, the Sheffield software group, on its main market IPO scheduled for December.

The float is expected to create a listed company with a market capitalisation of up to £140m.

Mr Naish said the combination of pension funds looking for better returns and a rise in asset values means that the markets are now “well and truly open”.

Advertisement

Hide AdAdvertisement

Hide AdThe Servelec float should net a healthy return for its owner, the Singapore-listed CSE Global.

It bought the business for £18.6m in 2000 and a £140m flotation will generate a near seven-times return on its original investment.

Last month, Wakefield-based Bonmarche announced its intention to float on the junior Aim exchange. US-owned private equity firm Sun European Partners has carried out a successful turnaround of the women’s fashion chain since buying it out of administration last year.

Bonmarche is expected to make its debut later this month.

Following speculation that DFS Furniture is poised for a £1bn stock market flotation, its chief executive Ian Filby said private equity backer Advent International has no plans to re-list the company.

The last Yorkshire company to float was WANdisco, the Sheffield software company which has been a soaraway success story since its stunning IPO in summer 2012.