Motley Fool: The Easy Way to Enjoy Multi-Bagging Profits

For example, a colleague told me Seaenergy might be a canny buy. Sea who? Exactly!

It turns out that the exciting thing about Seaenergy – an AIM-traded small-cap – is its imaging technology, R2S, which enables oil-rig operators to go on virtual tours of their rigs, rather than having to helicopter staff across the North Sea.

Advertisement

Hide AdAdvertisement

Hide AdHere’s another example – Neil Woodford’s recent investment in RM2 International. (RM2, R2S – I don’t blame you if you expect R2-D2 to be next to join the party!)

Despite the odd name, I wanted to discover why the famous fund manager had invested in a business that had only recently joined the market and pays no dividend.

It turns out RM2 has invented a revolutionary kind of pallet, BLOCKPal, that offers customers stronger, lighter and longer-lasting pallets.

Enthusiasts claim such pallets could replace many of the 12 billion or so wooden and plastic pallets used to transport goods around the world.

Advertisement

Hide AdAdvertisement

Hide AdRM2 only has a £250 million market capitalisation, so the potential rewards for early shareholders could clearly be vast. But what do I know about the pallet industry?

I don’t mean to imply it’s futile or boring to research new companies in unknown industries. On the contrary, doing that is one of the major attractions of investing for me.

Also, I’m obviously not the only person who doesn’t know their R2Ss from their RM2s. Making an extra effort to dig into these more obscure opportunities might well enable you to get in ahead of the crowd.

On the other hand, it might lead you to buy shares in a small, over-hyped company that you don’t really understand, with potentially disastrous results.

Advertisement

Hide AdAdvertisement

Hide AdHappily, you don’t need to root about in the obscure corners of the stock market to find great growth shares.

On the contrary, if you’re good at identifying big changes in everyday life, you might find them at your fingertips.

I’m thinking of US search engine giant Google.

August happened to be the tenth anniversary of Google joining the NASDAQ stock market in the US.

Like many people back in 2004, I already used Google every day. Indeed many times a day.

Advertisement

Hide AdAdvertisement

Hide AdI also knew about its growing advertising business, partly because of my day job but also because as an Internet user I saw Google ads popping up everywhere – including in my Gmail account, which I got into early, too.

Yet despite my familiarity with Google, I couldn’t get my head around its $27 billion valuation on flotation.

Ten years on, Google now has a market cap of $400 billion. That’s nearly a 15-bagger for those who had more foresight than me.

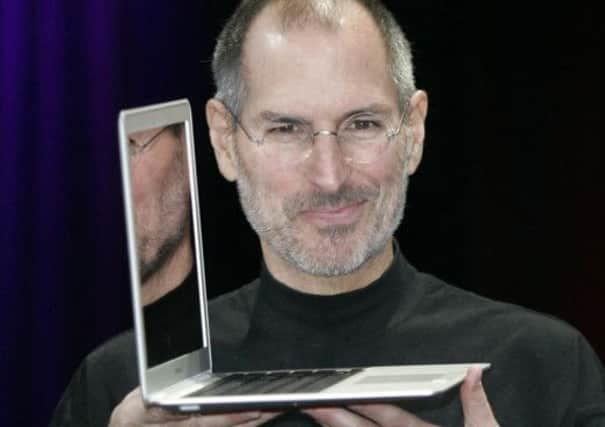

Another great example of an obvious company that was going places is Apple.

Advertisement

Hide AdAdvertisement

Hide AdI’ve been an Apple ‘fanboy’ for decades. I’ve only ever bought Macintosh computers, and I was an early adopter of the iPod, iPhone and iPad. My friends were all buying Apple products, too.

Yet I didn’t buy Apple shares in 2001 when the iPod came out, nor in 2007 when the iPhone arrived, nor on the debut of the iPad in 2010. Perhaps it always seemed a bit obvious?

Over the past ten years, Apple has been a 40-bagger for more sensible investors who spotted and invested in this wildly successful company.

Turning literally closer to home, what about Rightmove?

Some people may still buy homes without using the Internet, but I don’t know them.

Advertisement

Hide AdAdvertisement

Hide AdIn fact, I know plenty of people who browse the property listings on Rightmove for fun.

When it floated on the London Stock Exchange in 2006, I knew Rightmove, I used Rightmove, and my friends used Rightmove.

The shares then cost £3.35. Today they cost £25, making the company a seven-bagger for early investors. And that’s ignoring dividends.

Was it a no-brainer that Google, Apple and Rightmove’s businesses would grow so far, so fast, and thus deliver these extraordinary returns?

I don’t think so. Hindsight is dangerously seductive.

Advertisement

Hide AdAdvertisement

Hide AdThe point is not that identifying multibaggers is easy, but rather that to find them you don’t need to hunt for companies you’ve never heard of in industries you don’t understand.

Household names have made many investors rich in the past, and they will in the future. You get no extra marks – or money – for finding winning investments the hard way.

Motley Foolish investors concentrate on businesses, not share prices.

This means that understanding a business is paramount – and that it makes sense to start with the ideas that already surround you.

Advertisement

Hide AdAdvertisement

Hide AdIf you hold a stock for long enough, rising sales should ultimately translate into rising profits, and rising profits should result in a rising dividend.

If dividend growth features in your investing criteria, then I highly recommend this special free report for income investors like you, which we’ve named Five Shares You Can Retire On.

It’s completely complimentary for all Yorkshire Post readers, and is available at fool.co.uk/retire .