Motley Fool: The Investing Weakness That’s Holding You Back

I dipped into a pile of my favourite investing books: David Dreman’s Contrarian Investment Strategies, Howard Marks’ The Most Important Thing, Anthony Bolton’s Investing Against The Tide and Benjamin Graham’s The Intelligent Investor...

But from a wealth-building point of view, it turned out that one of the most thought-provoking reads was a book that wasn’t actually about investing in the first place. The words ‘investment’ and ‘share’, for instance, don’t even appear in the index.

Advertisement

Hide AdAdvertisement

Hide AdIt’s a book that has certainly given me pause for thought – and I reckon that its central message will probably help you in your investing, too.

I’ve written in the past about how I managed to double my pension - by switching to a low-cost SIPP stuffed with a few well-chosen index trackers and recovery stocks.

I’ve also written about my ISA portfolio of solid dividend-paying picks, and the low-cost Vanguard index trackers doing very nicely in yet another ISA wrapper.

But I’m the first to admit that a number of my moves have been more tactical than strategic – responding to the investment environment and opportunities of the day, for instance, rather than a bottom-up attempt to build the wealth that I’m counting on to fund my retirement.

Advertisement

Hide AdAdvertisement

Hide AdAnd to be sure, the cracks are starting to show. Since 2013 for instance, engineering company GKN, is up over 66 per cent, versus the FTSE’s more modest 14 per cent rise. At 393p, versus 149p when I bought it, GKN is up an impressive 165 per cent, and consequently offers a forecast yield of just 2.3 per cent on a P/E of 17. So what on earth is it still doing in my income portfolio?

A more rational approach would surely be to sell the stock, bank the gains, and pile into higher-yielding dividend stalwarts such as GlaxoSmithKline or AstraZeneca. Or even battered pasty retailer Greggs, if I wanted to play the same ‘recovery stock’ game that got me into GKN in the first place.

Currently unloved by the stockmarket – the company has nevertheless managed to raise its dividend for each of the last 28 years.

Put another way, for every £10 of income I currently receive from GKN could be doubled to £20 by selling GKN and moving the proceeds equally into Greggs, Glaxo and Astra. And that, for a purported income investor, should be the smart thing to do.

Advertisement

Hide AdAdvertisement

Hide AdAll of which takes me back to that book I mentioned. Published in 2012, Good Strategy, Bad Strategy by Richard Rumelt has apparently become something of an instant classic in business circles. An American professor who’s been retained by some of America’s largest companies to advise on strategy, Rumelt has a handy knack for explaining insightful strategic thinking.

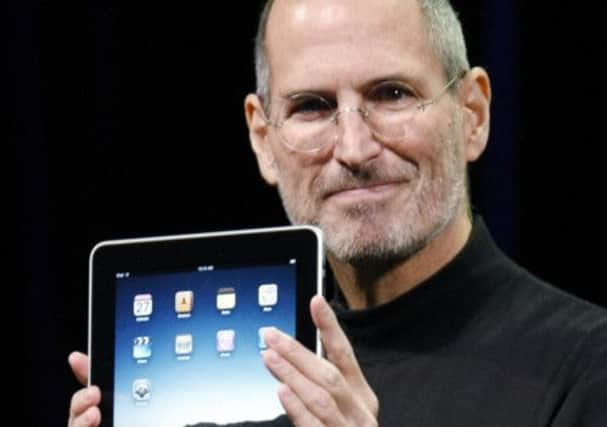

Why Apple went on to become the world’s most valuable business, for instance, while any number of other computer makers also named after fruit didn’t. (Anyone else remember Apricot Computers?)

But the real nub of the book is his unerring eye for picking out what makes a good strategy, and what makes a bad one.

Eloquently picking to pieces corporate disasters such as Enron, Lehman Brothers and International Harvester, Prof Rumelt ruthlessly savages sloppy ‘strategic’ thinking – which is precisely the sort of thinking that I’ve been guilty of at times, I’m afraid.

Advertisement

Hide AdAdvertisement

Hide AdTop of the list: leaders who mistake goals, objectives and exhortation for strategic thinking. Real strategy, in short, is how you’ll do something, recognising the challenges and resources constraints ahead. Strategy is most definitely not wishful thinking, aspirations or ‘stretch goals’.

For myself, I’ve resolved to do something about a number of investing decisions that seemed alright at the time, but which no longer suit my objectives as I get closer to retirement.

With GKN, for instance, I suspect that I’ll either sell soon, or nominate a future price at which I’ll sell. What I won’t do is continue to drift.

And as well as correcting past errors – although I’m not sure ‘error’ is the right word for a gain of 165 per cent – I clearly need to do some serious thinking about recent developments such as the brand-new pension reforms.

Advertisement

Hide AdAdvertisement

Hide AdYou’ll have your own thoughts about actions to take, I’m sure, prompted by the above. But let me leave you with a final thought…

At Motley Fool Share Advisor, our stock picks are divided into two different recommendation types – growth and income.

In other words, Share Advisor neatly complements two of the most popular investing strategies out there: generating growth, and generating an income.

And taking a quick peek at the team’s current picks, I was pleased to see many of them matched the stocks already in my own portfolio!

Advertisement

Hide AdAdvertisement

Hide AdWant some examples of these market-beating stock ideas? If you’re looking for income-producing shares with room to grow, check out our free investor report, for income-producing shares with room to grow, Five Shares You Can Retire On. It’s completely complimentary for all Yorkshire Post readers, and is available at at fool.co.uk/retire.