Store closure threat at BHS

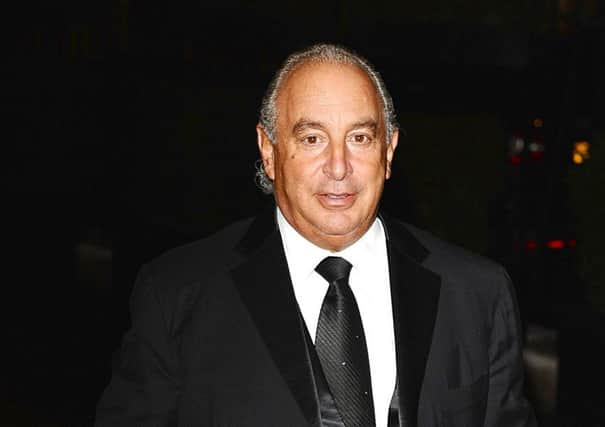

BHS was sold last year by British tycoon Sir Philip Green to a consortium of investors for what is believed to be a nominal sum. He exited the businesses nearly 15 years after buying the chain.

The group said that it was essential that it reset its costs in order to achieve a successful turnaround of a business that has been loss making for many years.

Advertisement

Hide AdAdvertisement

Hide AdThe high street chain is threatening to close around 40 of its stores.

BHS, which has 164 stores, says the use of the CVA would enable the business to address its legacy issue of over-market rents in a significant number of its stores.

The company said over-market rents have been causing those stores, and the group as a whole, to be underperforming financially.

Under the terms of the proposed CVA 77 stores would be unaffected, while 47 stores are seen as viable but BHS is seeking a reduction in rent to market levels.

Advertisement

Hide AdAdvertisement

Hide AdA further 40 stores will continue to trade for a minimum period of ten months whilst negotiations with landlords are undertaken to reduce the rents substantially.

Where rent reductions are achieved the stores will remain open, the company said. BHS added that it hoped that the store closure number would be kept to a minimum.

Darren Topp, chief executive of BHS, said: “Although a difficult process to go through, this sets in motion the comprehensive updated turnaround plan that we have identified, and gives British Home Stores a secure financial footing from which to grow and deliver sustainable profitability.

“BHS will continue to trade as usual and we thank our staff and customers for their continued support.”

Advertisement

Hide AdAdvertisement

Hide AdWill Wright, restructuring partner at KPMG and proposed supervisor of the CVA, said: “For almost 90 years, BHS has been one of the most iconic brands on the UK high street, but in recent years has seen its profitability decline as it has sought to respond to changing customer behaviours, increased competition and the rise in omni-channel retailing.

“Today’s CVA proposals are one facet of a wider turnaround plan, and specifically tackle one of the business’ largest fixed costs, the onerous lease arrangements across its UK-wide store portfolio.

“While the company’s store estate is located across favourable retail locations, a number of these leases are unsustainable, predicated on terms which were originally negotiated some decades ago. With the support of its lenders, shareholders and landlords, the company will be able to reshape its debt and operational structure to a model more suited to today’s multi-channel retail environment. The company needs to secure at least 75% creditor approval for these CVAs.”