Tesco climbs on industry data

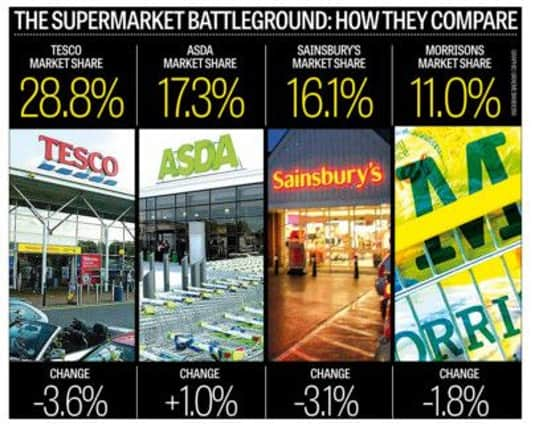

Britain’s biggest retailer saw sales fall by 3.6 per cent in the 12 weeks to October 12, its best performance since June, according to Kantar Worldpanel.

Investors bought in on the news, sending shares up by more than three per cent. The stock has halved in value this year.

Advertisement

Hide AdAdvertisement

Hide AdTesco is due to publish interim results and an update on its probe into a £250m profit mis-statement on Thursday.

Leeds-based Asda remained the star performer of the Big Four supermarkets and was the only one to achieve growth during the period, notching up a 1 per cent increase in market share.

Bradford-based Morrisons saw sales slip by 1 per cent, an improvement on the 1.3 per cent decline seen during the previous period.

Waitrose boosted sales by 6.8 per cent over the year to secure a record share of 5.2 per cent at the top end of the grocery market.

Advertisement

Hide AdAdvertisement

Hide AdAt the other end, German discounters Aldi and Lidl saw a slight fall in growth but still scored a big rise in sales of 27 per cent and 18 per cent respectively.

Clive Black, head of research at Shore Capital Stockbrokers, told The Yorkshire Post that the “free lunch” for Aldi and Lidl would soon be over, but predicted that the pair would be there at the end game for the sector.

He said: “The wholesale complacency, lack of reality and lack of touch with the consumer that the Big Four had over the last three or four years is coming to an end very painfully in terms of their profit margins.

“Over time there is going to be more fight back because necessity is the mother of invention. I think we are going to see a more competitive industry.

Advertisement

Hide AdAdvertisement

Hide Ad“Tesco is big and ugly enough to engineer an improvement, Asda smelt the coffee early and Morrisons and Sainsbury’s are probably where the worry lines are.”

The figures showed that like-for-like prices declined by 0.2 per cent, pushing the grocery market into deflation for the first time since the research started in 2006.

Fraser McKevitt, head of retail and consumer insight at Kantar Worldpanel, said consumers are benefiting as supermarkets battle it out on price.

He added: “Extensive price cutting by some supermarkets in a bid to win the price war means that customers are saving on everyday items such as vegetables and milk.”

Advertisement

Hide AdAdvertisement

Hide AdMr McKevitt said the market is waiting to see what Mr Lewis does at Tesco and predicted that a big price-cutting strategy would have a major impact on the sector. He added that the growth of the German discounters would continue and suggested that they might want to achieve a similar share in the UK to their position in Ireland.

Aldi’s UK share was 4.8 per cent during the period, while Lidl’s stood at 3.5 per cent. They have more than 16 per cent between them in Ireland.

Mr McKevitt said declining market share among the Big Four impacts the wider economy.