Yorkshire house price predictions and how your area has fared over the last ten years

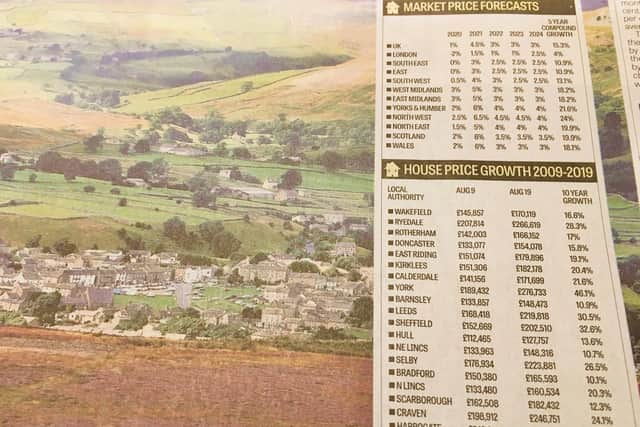

Yorkshire is forecast to see the UK’s second highest rise in property values over the next five years and the North will surge ahead of the South in predicted house price growth, according to Savills.The real estate adviser believes that values in our region will rise by 21.6 per cent between 2020 and 2024The North West is expected to see Britain’s strongest price growth at 24 cent, while the North East is joint third in the table with Scotland and could see a 19.9 per cent increase in house prices by the end of 2024.The UK average rise is predicted to be 15.3 per cent over the next five years, though the calculations assume that the forthcoming General Election does not result in a significant shift in policy and that the UK achieves an orderly exit from the EU over the course of 2020 and avoids recession. They also assume that the bank base rate increases gradually to two per cent by the end of 2024, constraining mortgage affordability and therefore house price growth.Lawrence Bowles, residential research analyst at Savills, says: “We predict house price inflation will ripple further north over the next five years. Affordability in regions such as Yorkshire and the Humber is far less constrained than in London and the South East, which means there’s greater capacity for house price growth.”Lucian Cook, Savills head of residential research, adds: “Markets further from the capital, such as Leeds, Liverpool, and Sheffield, were much slower to recover post financial crisis and have much greater capacity for house price growth relative to incomes, even as interest rates rise.”Average house prices are expected to increase by just 11 per cent across the South and East of England and four per cent across Greater London having outperformed the rest of the UK in the 7.5 years leading up to the referendum.However, prime central London, where median values stand at just over £2.75m, is forecast to be one of the strongest performing markets with a five-year growth of 20.5 per cent, reversing a trend seen over the past five years.

Welcome news

Ben Pridden, head of residential sales at Savills in Yorkshire, said that the figures were welcome news for the Yorkshire market.Savills also carried out exclusive research for Property Post showing how property values have fared in Yorkshire’s local authority areas over the past 10 years.

York tops price growth table

Advertisement

Hide AdAdvertisement

Hide AdIt used Land Registry figures that show York as the top performer. House prices in the medieval city have risen by 46.1 per cent over the past decade.Its appeal includes its historic good looks, easy access to both coast and country, its shops and restaurants and its transport links.York has the North York Moors, Hambleton Hills and the Wolds on its doorstep and is an hour’s drive from the coast.Its rail links to London, which is a two hour train journey, is a big attraction to buyers who work in the capital.While homeowners may be celebrating the increase in values, those struggling to get on to the property ladder are not. York is now the second least affordable area in Yorkshire with an average house price of £276,733.

Harrogate prices are highest

Harrogate is the most expensive place to buy a home with an average house price of £326,090. It also showed the second highest rise in property values over the last 10 years with a gain of 34.4 per cent.Sheffield, which was third in the house price inflation table, showed a gain of 32.6 per cent since 2009, bringing the average price to £202,510.Leeds was fourth with a rise of 30.5 per cent, which leaves the average home value at £219,818. Ryedale, which includes the popular market towns of Malton, Pickering and Helmsley, has surged in popularity over the past 10 years. It had the fifth greatest increase in values with a 28 per cent gain over the decade bringing the average house price to £266,619.The local authority areas with the lowest increases in prices over the last 10 years include Bradford, which was the worst performer with a 10.1 per cent growth and an average value of £165,593, though there are huge variations within Bradford City Council’s boundaries, which also include high value towns such as Ilkley and Skipton.North East Lincolnshire, which includes Grimsby, was second from bottom with a 10.7 per cent increase and an average value of £160,534. Barnsley barely managed double figures with a 10.9 per cent rise over 10 years bringing the average house price in the area to £148,473.

Expert opinion

Ben Pridden, head of residential sales at Savills in Yorkshire, says: “As a county, we have an enormous diversification of market dynamics and it’s hard to make comparisons across the districts, but fascinating to see how each area has fared. Despite York’s staggering recovery since the recession, it’s interesting to see that it is still within the top 10 areas of growth in the year to August 2019. The fact that Ryedale has seen the second highest annual growth demonstrates its popularity amongst buyers, particularly given that the area has seen the fourth highest growth in the county over the five years to August 2019. What I think we can take from these statistics, is that despite Brexit we remain in a positive situation across the region, which is more than many regions can claim.”For more details visit the Insight and Opinon section at www.savills.co.uk/insight-and-opinion/