How to log into all your bank accounts with a single app

For the most part, online banking is the same wherever you go: you can transfer money, apply for an ISA and not much else. Many banks no longer give you the option to download your data into an offline personal finance package because the companies behind those programs pulled out of the UK long ago.

In the US and Canada it’s a different story. A website called Mint.com reads transactions and balances from all your accounts, even if they are at different banks, and analyses the data to give you an overview of where your money is going.

Advertisement

Hide AdAdvertisement

Hide AdThere have been a couple of stabs at a British version of Mint.com, but our banks have fought tooth and nail against them, because they don’t want to share your details with third parties. It constitutes a security risk, they say. Riskier still, for them, is giving up to someone else the chance to sell you that ISA.

But that is probably about to change. The government wants our banks to open up access to customers’ data, to encourage innovation in the sector. It sees the system working in the same way as bus and train times, which are owned by the transport operators but made available to other companies who can surface the information in their own products. Obviously, a higher level of security is required for your bank details, but the principle is the same.

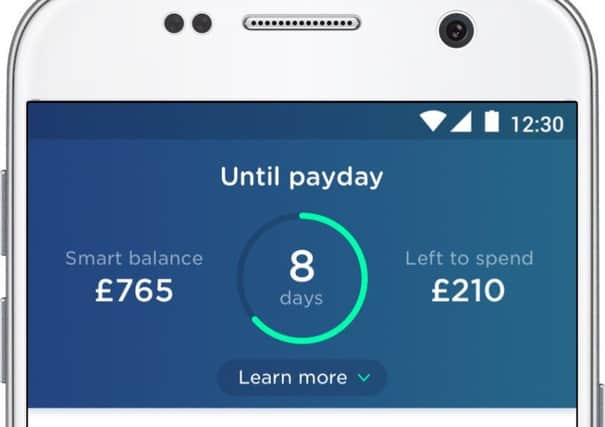

The first product to take advantage of this new era of openness has just been launched, though it’s still in beta. Yolt is owned by the Dutch bank ING and installs as an app on your Apple or Android phone. It logs into all your bank accounts and downloads your transactions, matching each against its database of companies. It knows, for instance, that Sainsbury’s is a supermarket and BT a broadband company, and categories your payments to them under groceries and household bills respectively. You can then see at a glance how much you are spending in each area and how much is coming into and going out of all your accounts.

The app takes account of future scheduled payments as well as past transactions, and you can set spending budgets and savings goals, and get warnings when you exceed them.

Advertisement

Hide AdAdvertisement

Hide AdBut that - for the moment - is about it. Though it may gain more functions in future, you are unlikely ever to be able to use it to transfer money or pay bills; you will have to use your bank’s own app or website for that. It’s quickler to log into Yolt than to access your bank - just a single five-digit PIN is needed - but you then need to update your balances manually, a process they are going to have to speed up.

You should also be aware that you may be running afoul of your bank’s terms and conditions by entering your login details in a third-party app. The new “open access” system will eventually nullify any such cavils, but until it has been rubber-stamped, it’s conceivable that your bank could try to blame you if your security is compromised.

Still, for all its limitations, Yolt is a step in the right direction - and a timely kick up the backside for a banking sector that has long been dragging its feet.