Fraud warning as mobile users bombarded with nuisance texts

Figures obtained by the Yorkshire Post show there were more than 55,000 cases of personal fraud, including identity theft, recorded at homes across the region last year.

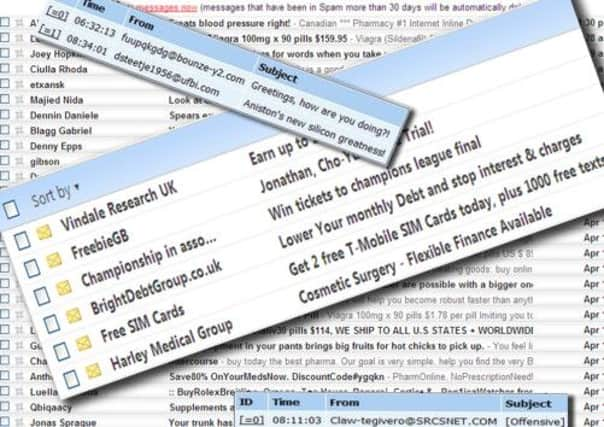

But such is the scale of the nuisance it has been estimated that as many as 8.7 million spam texts are being sent a day in the UK, many from difficult-to-trace numbers.

Advertisement

Hide AdAdvertisement

Hide AdLast night there were calls for urgent action to tackle the problem which regulators pledged was a “priority issue”.

Stuart Andrew, the Tory MP for Pudsey, said of spam texts: “They are a nuisance and they are increasingly becoming a greater nuisance.”

Unwanted messages are often sent at random and without permission about accident claims, Payment Protection Insurance (PPI) and pension reviews by rogue companies operating under the radar. If a person responds, their number is then sold on as someone interested in claiming.

In some cases, the Yorkshire Post has discovered criminals are behind unwanted texts.

Advertisement

Hide AdAdvertisement

Hide AdThey pose as somebody from a bank or other organisation or claim people have won the lottery to try to get them to part with the personal details they need to commit fraud.

A spokesman for CIFAS, the UK’s fraud prevention service, said: “The motive will always, ultimately, be money: either to get people to make a payment or hand over their details so that the fraudster can then go and use the account to spend money or impersonate the victim to obtain a new account in their name.”

The Pensions Regulator has warned people of a scam where savers received spam texts or calls enticing them to release their pension early.

They are duped into transferring their funds to rogue pension arrangements, often overseas, for a commission fee and are left with a hefty tax bill.

Advertisement

Hide AdAdvertisement

Hide AdPersonal fraud figures from CIFAS show urban areas including Sheffield, Leeds and Bradford are being hit especially hard.

Mr Andrew, one of the MPs representing Leeds, which saw 11,452 cases of personal fraud, urged people to be vigilant: “Often people who are victims of identity fraud often find out when its too late.

“Anything that can be done to lessen that needs to be done.”

It is against the law for companies to send marketing texts unless people have given them permission. This can have been done in a number of ways such as by making a purchase and agreeing to receive marketing information.

Advertisement

Hide AdAdvertisement

Hide AdThe Information Commissioner is concerned companies are operating under the radar and in 2011 the Justice Committee, a parliamentary committee which looked at the issue, said it had been struck by the “range of illegal behaviour that referral fees can reward, from individuals stealing data to companies with contracts or practices which breach the Data Protection Act to the sending of spam text messages to mobile telephones”.

John Mitchison, head of preference services at the Direct Marketing Association, said its research suggested 8.7 million spam texts a day were being sent.

“The big thing that I think would help deter people from sending out these messages is more enforcement,” he said.

“There’s a legitimate industry out there that’s being tarnished with the same brush.”

Advertisement

Hide AdAdvertisement

Hide AdMany texts are being sent from difficult-to-trace pay-as-you-go phones.

A spokesman for the Information Commissioner said: “Tackling nuisance marketing calls and spam texts is a priority issue.”

He added: “We are currently speaking with the most complained about organisations to ensure that they are complying with the regulations.

“We are also in the processes of issuing monetary penalties to several other companies that we believe have been involved in unlawful marketing practices.”