Life is sweet(ish) as recession’s darkest days fade in memory of entrepreneurs

At the Oldest Sweet Shop in England, in between serving customers and restocking the shelves, owners Keith and Gloria Tordoff, have been busy formulating a plan. If it comes off, the couple hope that come next summer their business in Pateley Bridge will receive the same kind of boost local cyclists are currently getting from the Scottish butter tablet they’ve been marketing as rocket fuel.

“It’s hilly round here and if you are going to get into the next Dale you need an injection of energy,” says Keith, himself a keen cyclist. “We’ve had our eye on the Tour de France ever since it was announced the Grand Départ is coming to Yorkshire. When you are an independent business, you have to make the most of every opportunity and this could be a big one for us. The rocket fuel sweets are a little bit of a gimmick, but it’s about raising our profile and getting people inside the shop. If we get it right it could be the busiest summer we’ve had in years.”

Advertisement

Hide AdAdvertisement

Hide AdIf it is, the dark days of 2008 will seem a long time ago. The Tordoffs were one of a number of businesses the Yorkshire Post contacted when the prospect of a recession was first mentioned. We asked each for their economic forecast and while the odd one was still clinging to the possibility that the worst case scenario could be avoided, most were braced for the worse. As it turned out they were right to be pessimistic.

Bank bailouts were followed by rising youth unemployment and as borrowing tightened it was often small businesses which felt the squeeze. However, after half a decade of belt-tightening, the mood music coming from government seems significantly more upbeat. Word has it the economy has now turned a corner. Keith certainly thinks so.

“Confidence is definitely returning,” he says. “Over the last five years we have had to be very tactical. Instead of placing orders of stock worth £2,000, we’ve may be spent £700. Our suppliers have been very understanding, but we are still here, they’re still here and hopefully the pressure that people have felt under will start to ease.

“The one thing we did do in the quiet times – and there have been quiet times – was to take the opportunity to invest in our website and really embrace social media. This might be a heritage business, but what the recession really clarified for us, is that you can’t stand still.”

Advertisement

Hide AdAdvertisement

Hide AdWhile the jury may still be out on whether Britain’s economic condition can yet be described as stable, there are signs that we are at least heading in the right direction. Manufacturing has seen its sharpest rise in sales since the early 1990s and the service industry has seen orders increase at their fastest rate since 2007.

The figures were published as part of the British Chamber of Commerce’s quarterly survey, with the organisation indicating the results meant it was likely to revise its GDP forecasts upwards. The upturn – if that what it proves to be – is, however, too little too late for some.

Six years ago, before the scale of the impending property crash was laid bare, many of those involved in the sector were being determinedly upbeat. David Hattersley was typical of them. Then managing director of the York-based de Bretton Group had spent £20m in less than three years building an impressive property portfolio. It included a number of bars and hotels, but the jewel in the crown was his purchase of the historic Lendal Tower, which he planned to turn into a luxury holiday let.

His gut feeling then was that so long as the wind was behind us we’d miss the recession by the skin of our teeth.

Advertisement

Hide AdAdvertisement

Hide AdUnfortunately, it changed direction and the speed at which the credit crunch bit surprised many. Within two years, Mr Hattersley had declared himself bankrupt and his ambitious plans for the city lay in tatters.

And that’s how it remained. However, in the last five months there has been signs of much needed life among York’s historic streets. Chef Andrew Pern has opened what will hopefully be a flagship restaurant on the banks of the Ouse and just a little further up the river, work has finally started on developing the long-derelict Bonding Warehouse. Closed 13 years ago following devastating flooding, the 19th-century building is now the subject of an ambitious redevelopment which will see the upper levels turned into apartments, while the ground floor will be available for offices and there will also be potential for a restaurant.

It’s early days yet, but the scaffolding has gone up, much of the flood defence work has been done and the York office of Lindum Group is currently tackling the roof.

“The construction industry is a barometer of what’s happening in the wider economy,” says Neil Coote, the company’s business development manager. “In a recession we not only get hit first, but we get hit the hardest and for the longest.

Advertisement

Hide AdAdvertisement

Hide Ad“However, a lot of schemes which were mothballed when the recession hit do now seem to be being taken on with renewed confidence by developers. We employ 500 staff and while the last few years have not been easy we have not had to make any redundancies.

“I definitely think a lot of companies are now looking forward. We opened our York office last September and some people might have thought that was a bit rash, but we definitely believe that there are grounds for optimism.”

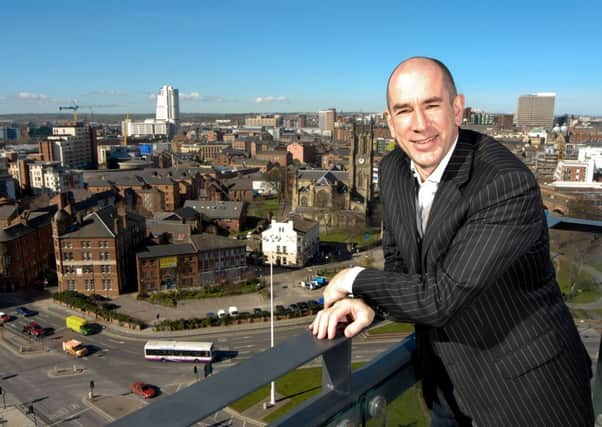

It’s a mood reflected by Jonathan Morgan, who as managing director of specialist estate agent City Living Leeds was for a while in the eye of the storm.

In 2008 he was worried the country was in danger of talking itself into a recession. Five years on, he says, that same negative press is still having an impact.

Advertisement

Hide AdAdvertisement

Hide Ad“Only last week I was talking to someone from London and one of the first things they said was, ‘So how many empty flats have you still got in Leeds?’ There’s no denying there was a problem, but the city itself gained an unfair reputation.

“After the financial markets crashed following 9/11 people wary of putting their money into stocks and shares began investing in property. Developers began building housing stock to satisfy investors rather than buyers, hence the rash of flats.

“However, we always said supply would dry up. It has and now we are in the position where we can look forward. The truth is that we are urgently in need of new housing and one which really reflects the needs of buyers. Yes, Leeds needs flats, but it also needs traditional two-storey homes with outside space. Crispin Lofts in the city’s Northern Quarter is a prime example of the sort of scheme the city needs. Rushbonds took a striking building, which had been derelict for more than 10 years and we let all 80 apartments within a matter of months.

“I think there is definitely a lot to be optimistic about. Leeds’s population will soon reach one million, projects like Trinity Leeds and the new arena are creating new jobs and those people need somewhere to live. What we need to make sure now is that there is the right kind of properties available to ensure that long term prosperity.”

Advertisement

Hide AdAdvertisement

Hide AdIf there was one couple most worried by the looming recession back it was Steve and Julia Holding. Just before the economy nose-dived, the couple, who had previously run a pub in Sutton-on-the-Forest, ploughed everything into opening their own café and deli. They admit now that The Pig and Pastry in the Bishopthorpe Road area of York was a risk, but the gamble appears to have paid off.

“At the start we did hold our breath for a while as we had possibly picked the worst ever time for launching a new business,”says Steve. “But five years on things couldn’t be better. We’ve got a loyal customer base, but I guess the trick is not to get complacent. We’ve had offers to expand, but for now at least we are happy as we are.”

Quiet contentment was something many business owners five years ago could only have dared to dream of.

Retail sales point the way

Figures released early this month showed retail sales had grown faster than expected in September. While the difference may have been minimal when it comes to charting the economy’s rise and fall every percentage point counts.

Advertisement

Hide AdAdvertisement

Hide AdAccording to the Office for National Statistics, retail sales rose 0.6 per cent on the month against a predicted rise of 0.4 per cent. However, many pundits have been cautious about talking up the results.

In response to a rise in manufacturing sales, John Longworth, the British Chambers of Commerce director general, said: “We need to ensure that this does not become an aberration, but rather the norm, particularly when the economic recovery is still facing external risks.”