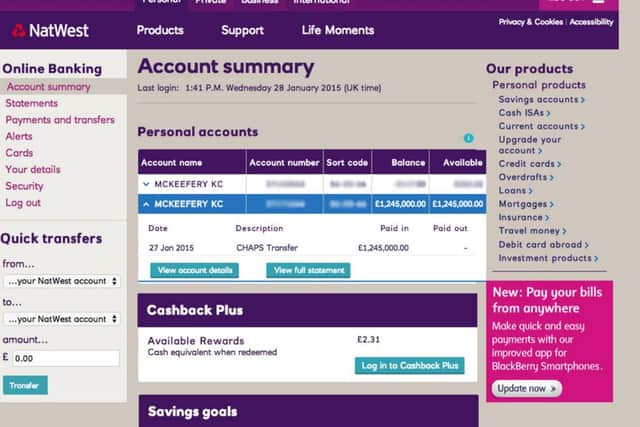

There’s an extra £1.25 million in my bank account

Kieran McKeefery, 21, couldn’t believe his eyes when his bank balance had been boosted by an incoming cash transfer of £1,245,000.

After mulling over what he could spend the cash on, the web designer phoned his bank, Natwest, and asked them to investigate.

Advertisement

Hide AdAdvertisement

Hide AdThe bank could only tell him the enormous bank-to-bank same-day payment had coem from a huge investment company - and it was up to their bank to take it back.

It was an agonising ten days before the company retrieved the cash - but leaving tempted Mr McKeefery with a bonus £210 of interest.

Mr McKeefery said: “I checked my online banking and immediately I noticed I had £1.25 million in the bank.

“I was a bit fazed at first. It was such a copious amount of money to be in my bank.

Advertisement

Hide AdAdvertisement

Hide Ad“It was very strange and quite scary when you are in that position, checking your bank to see if £1.25 million is in there.

“I didn’t know what to do, except just wait and think about all the things I could have spent it on.

“I thought ‘oh god, what has happened’ - I was a bit shocked more than anything else.

“I called the bank and they said they would look into it.

“I was kind of tempted [to spend the money] but I had read stories about people spending money mistakenly placed in their accounts and getting in trouble.

Advertisement

Hide AdAdvertisement

Hide Ad“I spoke to my partner and she said to just leave it there and don’t touch it.

“I was buying a new car the next day and I could have paid for it in cash - and bought quite a few more - with the money in my account.

“The bank wasn’t really playing ball. It was a bit crazy really. I had all this money in my account and they said they had made the request [to the payee’s bank] and I just had to wait. They said it was up to them to sort it.”

The massive payment was marked only as ‘CHAPS Payment’ - a Clearing House Automated Payment System - on January 27.

Advertisement

Hide AdAdvertisement

Hide AdPanicked Mr McKeefery immediately called Natwest who said the payment had come from an investment company via their bank.

They said they would alert the payee’s bank of the mistake - but that it was up to them to take it back.

Over the next ten days he called his bank in a bid to speed up the move, but it wasn’t until February 6 the cash disappeared, leaving him with £204 interest.

“The interest was pretty good really and they haven’t asked for it back,” said Mr McKeefery.