Interest rates slashed to historic new low in post-Brexit scramble: What does it mean for savers and borrowers?

Governor Mark Carney said Britain’s economy had received the shot in the arm needed in the face of the “new reality” of Brexit.

Mr Carney said the Bank had delivered a “timely, coherent and comprehensive” package of measures and said the rate cut would be felt “immediately in the economy”.

Advertisement

Hide AdAdvertisement

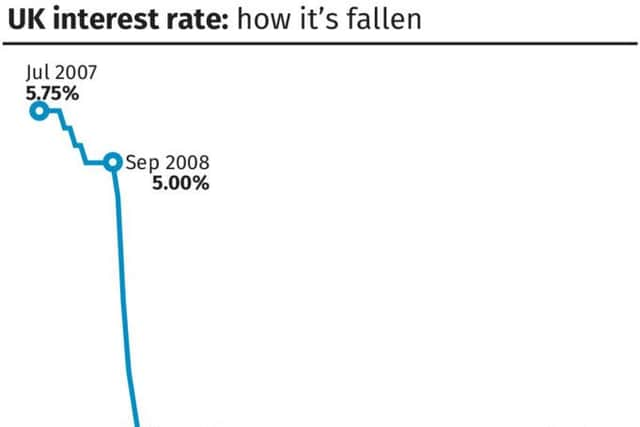

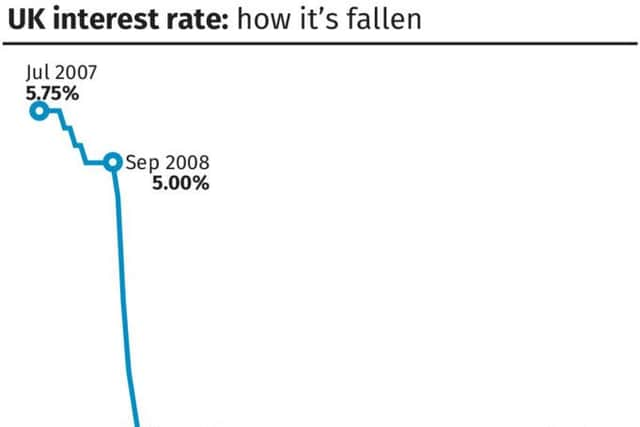

Hide AdPolicymakers on the Monetary Policy Committee (MPC) voted unanimously to cut rates to a new historic low of 0.25% from 0.5% - the first cut since March 2009, when the Bank reduced rates at the height of the financial crisis.

It also revealed its biggest growth downgrade since the MPC was created nearly 20 years ago.

The Bank believes the measures will see the UK narrowly avoid recession, but it warned there may be a “material slowdown”, higher unemployment and falling house prices over the next year.

Mr Carney said the changes needed in the economy following the Brexit vote “may prove difficult and many will take time”.

But he insisted: “The UK can handle it.”

Advertisement

Hide AdAdvertisement

Hide AdHe said: “We have, in the actions we have taken today, improved the economic outcomes for this country.

“There will be less unemployment, more activity and a greater prospect of a successful adjustment to the new reality that the UK faces.”

The Bank’s economy-boosting action will see it fire up the printing presses once more to expand its £375 billion quantitative easing (QE) programme by £60 billion to £435 billion - the first QE increase since 2012.

It is also buying £10 billion of corporate debt and announced a new scheme worth up to £100 billion to encourage banks to lend to households and businesses.

Advertisement

Hide AdAdvertisement

Hide AdAnd more rate reductions are on the cards, with the minutes of the MPC meeting revealing most members expect to cut rates to a “little above zero” by the end of the year if growth slows as expected.

But Mr Carney appeared to rule out the prospect of negative interest rates, saying he was “not a fan”.

He admitted savers would continue to suffer low returns after the rate cut, but assured they would benefit from a “better economic outcome” from rock bottom rates.

Borrowers should see immediate benefits, though, and Mr Carney said banks had “no excuse not to pass on this cut”, thanks to the Bank’s package of measures.

Advertisement

Hide AdAdvertisement

Hide AdChancellor Philip Hammond welcomed the MPC’s action and in a letter to Mr Carney he added was “prepared to take any necessary steps to support the economy and promote confidence”.

He added: “The governor and I have the tools we need to support the economy as we begin this new chapter and address the challenges ahead.”

The FTSE 100 rose almost 100 points to 6,731 in afternoon trading following the announcement, gaining 1.47%.

Sterling went in the opposite direction, plummeting 1.18%, or 1.5 cents, against the US dollar to stand at 1.31.

Against the euro the pound also dropped, by 1.04% to 1.18.

What it means for savers

Advertisement

Hide AdAdvertisement

Hide Ad• Nearly three-quarters of current accounts on the market now pay a zero rate of in-credit interest. Moneyfacts.co.uk recently found that around 72% of current account deals do not offer an interest rate on credit balances, although some of these could offer other “perks” such as cashback.

• The average “no notice” Isa interest rate on offer is less than 1%. A typical no-notice Isa on the market in August was paying 0.95%, according to Moneyfacts. A year ago, the average rate was 1.11%.

• For every savings rate that has been increased in 2016, around nine have been cut, Moneyfacts’ data shows.

... and for borrowers:

• More than two million recent home buyers are likely never to have experienced a hike to their mortgage rates, having got on the property ladder while rates were static or falling.

Advertisement

Hide AdAdvertisement

Hide Ad• A spate of mortgage price wars has pushed rates to record lows. Notable deals launched recently include a two-year fixed rate from HSBC at 0.99%.

• As well as rates, mortgage lenders have also been getting more competitive with the fees that come with their deals - with growing numbers of fee-free offers. Borrowers can now choose from more than 1,200 mortgage deals with no arrangement fee, according to Moneyfacts, up from just over 500 two years ago.