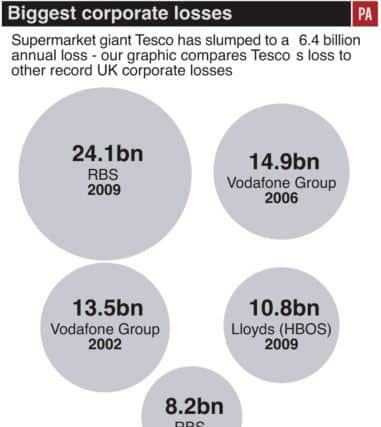

Video and timeline: Yorkshire workers face redundancy as Tesco posts ‘eye-watering’ £6.4bn loss

It is not yet clear how many Yorkshire suppliers will be dropped from Tesco’s lists.

Workers at Rachel’s Organic yogurts have been put on notice of redundancy following the decision by Britain’s biggest retailer to stop stocking the brand from the end of April.

Advertisement

Hide AdAdvertisement

Hide AdAnother high profile casualty is Kingsmill bread following Tesco’s decision to focus on Warburtons, Hovis and own-label brands.

Mr Lewis, dubbed “Drastic Dave” after his decision to cull jobs and close loss-making stores, said: “There will be some suppliers that lose listings, but it’s because customers are not buying the products. You don’t shed 30 per cent of the product range without some impact on suppliers.”

He declined to be drawn on how many suppliers will be affected, but said the process will take 18 months to complete.

“Having taken 31 per cent more range into the business in the last two years we are taking that back. It does mean we’ll take ranges out of the business,” he said.

Advertisement

Hide AdAdvertisement

Hide AdSuppliers are already feeling the squeeze due to a fierce price battle between Tesco and its main rivals, Asda, Sainsbury’s and Morrisons.

Some 146 food producers entered insolvency in 2014, up from 114 in 2013, according to accountants Moore Stephens.

Tesco was hit by a £263m accounting scandal last year involving its relationships with suppliers after booking deals too early, prompting a criminal investigation by the Serious Fraud Office.

Tesco said it is increasing transparency and seeking to build “longer-term, mutually beneficial partnerships” with its suppliers as it tries to rebuild trust in the market.

Advertisement

Hide AdAdvertisement

Hide AdIt is also seeking to simplify the deals it negotiates with suppliers. It currently has over 20 different payment terms but plans to reduce this drastically.

Mr Lewis said: “The market is still challenging and we are not expecting any let-up in the months ahead. When you add to this the fundamental changes we are making to our business and our offer, it is likely to lead to an increased level of volatility in short-term performance.

“Our clear priority - and the one that will deliver sustainable value for our shareholders - is to improve consistently for customers. The changes we have made, and will continue to make, put us in a stronger position to do this.”

Since the arrival of former Unilever executive Mr Lewis, it has announced the closure of 43 loss-making stores as well as shelving plans for a further 49.

Advertisement

Hide AdAdvertisement

Hide AdToday’s write-down includes £3.8 billion from a review of its store portfolio in light of industry conditions and declining profits. It also wrote down the value of work in progress by £925 million following the decision in January not to proceed with the 49 sites in its property pipeline.

Tesco has also agreed a contribution of £270 million a year to its pension fund after a valuation revealed a deficit of £2.8 billion at the end of March last year.

The group has shut its final salary pension scheme and sold its loss-making blinkbox online video operation. It plans to save £250 million a year by shutting its headquarters in Cheshunt and has axed its dividend this year.

Tesco has recruited former Dixons chairman John Allan to head its board and succeed Sir Richard Broadbent, who left after the discovery last autumn of a £263 million accounting blunder, now being investigated by the Serious Fraud Office.

Advertisement

Hide AdAdvertisement

Hide AdMr Lewis said the company had added a net 4,652 customer-facing roles in stores since September, while cutting the number of head office jobs.

Tesco shares were 2% higher at one stage as investors welcomed the signs of improved trading after UK like-for-like sales rose 0.6% in the final quarter of the financial year. Total UK sales for the year were £44.6 billion, down 1.8%.

Shore Capital analyst Darren Shirley said such a bottom-line loss would have been seen as “unfathomable” not so long ago.

He said: “Whilst the challenges are considerable and there is no quick fix to Tesco’s problems, with little or no hope to our minds of achieving the performance levels of halcyon days of old, we are pleased with the management team that has been put into place, which gives us some confidence of improvement and better times ahead.”

TIMELINE OF TESCO’S TROUBLES

• February 2011

Advertisement

Hide AdAdvertisement

Hide AdSir Terry Leahy steps down as chief executive on his 55th birthday after 14 years in charge, during which he oversaw a leap in pre-tax profits from £750 million in 1997 to £3.4 billion at the last set of annual figures in April 2010. The market share of the group stands at 30.5%.

• January 2012

Less than a year into Mr Clarke’s tenure, Tesco shocks the market with its first profit warning in almost 20 years after poor Christmas trading. Shares plunge by as much as 15%, or more than £4 billion, as it finds itself squeezed by discounters Aldi and Lidl and upmarket Waitrose and Marks & Spencer.

• April 2012

Tesco unveils a £1 billion UK revival plan, which includes upgrading stores, the recruitment of more staff and better prices and value. The initiative follows complaints that its 2,800 stores are cold and industrial with poor levels of service.

• April 2013

The retailer reports its first fall in annual profits in 19 years, with post-tax profit tumbling almost 96% to £120 million from a year earlier. The figure is hit by a £1.2 billion charge on the retailer’s US Fresh & Easy chain of around 200 stores as it confirms it will leave the country. The firm also suffers an £804 million writedown in the UK on land for more than 100 major stores, bought at the height of the property boom, which will no longer be developed.

• February 2014

Advertisement

Hide AdAdvertisement

Hide AdThe supermarket promises to spend an additional £200 million on lower prices for basic products, such as carrots, tomatoes, onions, peppers and cucumbers. It will also rein in annual capital spending to no more than £2.5 billion for at least the next three years as a result of the dramatic reduction in store expansion - nearly half the £4.7 billion spent in 2008/09.

• April 2014

Mr Clarke brushes off speculation about his future despite little sign that his £1 billion plan to turn around the retail juggernaut is bearing fruit. Profits fall 6.9% to £3.05 billion for the year to February 22 while fourth-quarter like-for-like sales slump by 3% as its UK market share falls to 28.6% in the 12 weeks to March 31, from 29.7% in the same period a year earlier.

• June 2014

Till-roll figures from Kantar Worldpanel show a decline in Tesco’s market share to 29% in the 12 weeks to May 25, compared with 30.5% a year earlier. A day later, the chain reports a 3.7% fall in like-for-like sales for the first quarter of its financial year. It is a performance that Mr Clarke admits is the worst he has seen in four decades at the supermarket chain.

• July 2014

Tesco announces that Mr Clarke will step down from the board on October 1 to be replaced by Unilever executive Dave Lewis. Sales and trading profit in the first half of the year are “somewhat below” expectations, the company adds.

• August 2014

Advertisement

Hide AdAdvertisement

Hide AdThe change at the top of the supermarket is brought forward by a month to allow Mr Lewis to commence a review of ‘’every aspect’’ of the group’s operations. The move comes after the chain reveals another profits warning and slashes its dividend to shareholders by 75%.

• September 2014

The previous month’s guidance turns out to be too optimistic as the company reveals it has overstated profits by £250 million. It asks Deloitte to carry out an investigation into the error, which relates to timing issues on when Tesco’s UK business reports the income it receives from suppliers.

• October 2014

The Financial Conduct Authority launches a probe into the dodgy numbers as the company suspends eight executives. US investment guru Warren Buffett offloads his Tesco shares, labelling his investment a “huge mistake”. When its latest figures are finally published they reveal a 91.9% plunge in first half pre-tax profits to £112 million. Tesco also reveals the original overstatement estimate was an understatement - £263 million, not £250 million. The group’s chairman, Sir Richard Broadbent, says he is preparing to step down, saying “the issues that have come to light are a matter of profound regret”. Days later Tesco is formally placed under criminal investigation by the Serious Fraud Office.

• December 2014

Dave Lewis spells out the scale of the problems facing Britain’s biggest supermarket as it issues a £500 million profits warning. Accounting watchdog the Financial Reporting Council (FRC) launches an investigation into the £263 million profits overstatement.

• January 2015

Advertisement

Hide AdAdvertisement

Hide AdTesco announces it is shutting its head office as well as 43 unprofitable stores as part of a raft of new measures as new boss Dave Lewis battles to turn around the group’s fortunes. The store closures threaten the future of around 2,000 jobs.

• February 2015

The Groceries Code Adjudicator, Christine Tacon, says she has formed a “reasonable suspicion” that Tesco has breached the Groceries Supply Code of Practice. Her investigation is expected to take up to nine months as she seeks more information from direct suppliers and others to determine what further action to take.

April 2015

Tesco slumps to a massive loss of £6.4 billion due to £7 billion of one-off items, including £3.8 billion from a review of its store portfolio in light of industry conditions and declining profits. Underlying profits were 68% lower at £961 million but Mr Lewis said the company had drawn a line under the past.