Banks withdraw from ‘complex’ safe deposit sector

Increasing costs and complexity have been cited as reasons for the move, which has left many high streets without secure custody facilities.

HSBC became the latest bank to withdraw the service, which allows customers to store high value items within the bank’s high-security vaults.

Advertisement

Hide AdAdvertisement

Hide AdThe bank had previously offered safe deposit box rental to HSBC customers at six sites, including two Manchester branches. It closed the service for non-HSBC customers in 2008.

A spokeswoman for the bank said it had started closing the service for “commercial reasons”.

Other high street banks have also moved out of the sector in recent years.

Lloyds Bank closed its safe deposit services to new customers in 2011, although it does continue to run a service for customers with items already in secure custody.

Advertisement

Hide AdAdvertisement

Hide AdBarclays, Natwest, Royal Bank of Scotland and Yorkshire Bank have all reduced or removed their safe deposit services.

A Barclays spokeswoman said the bank closed the service on a phased basis from 2010, with it being fully withdrawn by 2013.

“The decision to withdraw the service was taken after careful consideration as it was becoming increasingly complex and costly for us to continue to provide the service,” she said.

A spokeswoman for the British Banking Association (BBA) said the provision of safe deposit boxes is a commercial decision to be taken by the business.

Advertisement

Hide AdAdvertisement

Hide Ad“Whether a bank offers safe deposit or whether it doesn’t is purely the decision of the bank,” she added.

St James’ Safe Deposit managing director Nigel Kay told The Yorkshire Post that customer demand has been rising at a steady rate in recent years.

As safe deposit is not a core business, the banks may view it as an “irritant”, he said.

A lack of confidence in the financial sector may also have contributed to customers moving to private sector safe deposit providers, thereby leading banks to close the service as they have “not been making enough money out of it”, Mr Kay said.

“Demand has been steadily rising,” he said.

Advertisement

Hide AdAdvertisement

Hide Ad“It’s really in the last five years that there has been a sustained growth, which I think comes back to this lack of confidence.”

The trend for local bank branch closures in banking may have also contributed to banks’ decisions to stop providing services, Amanda Williams of St James’ Safe Deposit said.

She said: “Many of the smaller local branches used to have safe deposits and it’s a natural next step to see them close them at national level.”

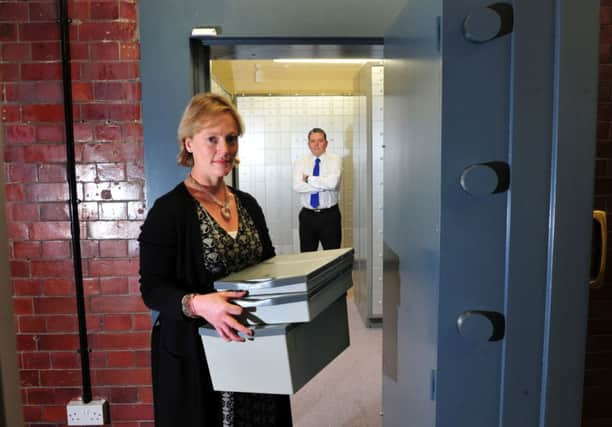

This month marked the opening of St James’ Safe Deposit in Leeds, bringing secure storage services back to the city.

Advertisement

Hide AdAdvertisement

Hide AdIt is thought to be more than 60 years since a private safe deposit service was available in Leeds, since the closure of the Leeds Safe Deposit Company in 1954.

The Leeds branch, which uses former bank vaults in the basement of the Greek Street Chambers building on Park Row, is the second for the company and currently has 1,500 boxes, with capacity to expand.

Amanda Williams, director at St James’ Safe Deposit, said customers have been “very impressed” with the facilities.

“It’s in former bank vaults and we’ve had a private security company come in and advise us on the security aspects,” she said.

St James’ Safe Deposit was founded in Manchester in 1912, something.

The long trading history is also a reassurance for customers, Ms Williams said.