Beauty and lifestyle group THG ‘confident’ of further progress as losses narrow

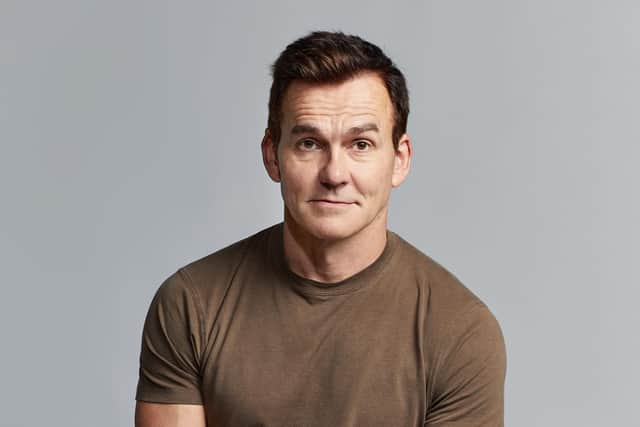

Mr Moulding described 2023 as a year “not without its headwinds”, adding that the group had responded “proactively” to challenges and emerged from the year stronger.

The group posted a pre-tax loss of £252m for the 12 months ended 31 December 2023, down from £549.7m in the year prior. Revenue for the year fell by 8.4 per cent to around £2bn, but the group returned to revenue growth in the final quarter with a small jump of 1.1 per cent.

Advertisement

Hide AdAdvertisement

Hide AdMr Moulding described the growth as “especially pleasing”, and said that the momentum had “continued into 2024.”

The group reported adjusted EBITDA growth of 48.8 per cent, up to £120.4m. This comes after the group posted guidance in January of “above £117m”.

THG is made up of THG Beauty, THG Nutrition and THG Ingenuity. The firm controls brands including My Protein, Look Fantastic and Cult Breauty.

Mr Moulding said: “2023 was a year of material operational progress and execution for THG, as we continued to grow our category-leading, global brands through digital transformation, innovation and impactful partnerships. It was certainly not without its headwinds, but the Group responded proactively, and emerged stronger.

Advertisement

Hide AdAdvertisement

Hide Ad“Following the challenging global environment in 2022, we repositioned our three businesses to focus our resources onto margin recovery and a return to sustainable revenue growth. Overall, the performance was highly encouraging, and although we have more work to do in 2024, I am confident we have the right people, capabilities and expertise to make further progress.”

Mr Moulding added that the group had increased its use of AI and automation during 2023, leading to reduced distribution costs.

He said: “Our fulfilment network is becoming increasingly optimised through a combination of robotics automation, AI and the onboarding of new Ingenuity clients utilising existing capacity.”

These changes meant that adjusted distribution costs for the firm substantially reduced year-on-year to 13.2 per cent of revenue, down from 15.5 per cent in 2022.

Advertisement

Hide AdAdvertisement

Hide AdTHG said that its start to 2024 had provided it with confidence in delivering in accordance with market consensus, adding that overall revenue trends “continue to improve”

The group broke even on cash flow in the year, compared to a £213m outflow in the 2022 financial year.

Despite global de-stocking affecting manufacturing volumes in the first half of the year, THG Beauty generated revenue of £1.2bn in 2023, with online retail making up 80 per cent of this.

THG Beauty also generated an increased Adjusted EBITDA of £44.2m, up from £33.6m in 2022.

Advertisement

Hide AdAdvertisement

Hide AdIn December of 2023, THG Beauty acquired skincare firm Biossance. THG said the acquisition provides further opportunity for it to “embed new strategic partnerships and benefit from the significant levels of investment into the brand that were made under the previous ownership.”

Biossance was founded in 2015 and has generated global revenues of around £238m. Its products are stocked in stores including Sephora, Harrods, Space NK, Douglas and Selfridges.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.