Chicago firm comes calling with deal for credit-checking agency

Leeds-based Callcredit Information Group announced today that private equity firm GTCR has joined forces with the management team to acquire the business.

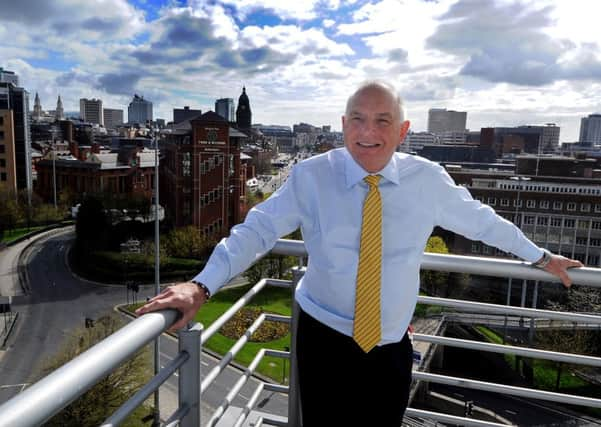

GTCR and Callcredit’s management, led by chief executive John McAndrew, are investing in the company to help it grow organically and through potential acquisitions. GTCR is acquiring the company from Vitruvian Partners, which has owned Callcredit for five years.

Advertisement

Hide AdAdvertisement

Hide AdThe financial details have not been disclosed, but it has been reported that Vitruvian Partners had been hoping to attract a price of around £400m.

Callcredit saw its turnover and profits soar last year as banks, insurers and retailers invested in new ways to find out about their customers. The company reported a 25 per cent rise in turnover to £114m and a 40 per cent rise in operating profits to £17.3m.

Callcredit has more than doubled in size since it was sold by Skipton Building Society to Vitruvian Partners for a reputed £120m in 2009.

Mr McAndrew said yesterday: “I am extremely pleased that Callcredit is partnering with GTCR. They understand technology and added-value growth. They are very clear in wanting us to continue to succeed by helping our customers thrive in this challenging environment of increasing regulation, rapid technological change, and heightened competition.”

Advertisement

Hide AdAdvertisement

Hide AdCommenting on the new owners, Mr McAndrew said: “We have been getting to know them over the last six months. They’re looking to invest in growing technology businesses with management teams who have helped to build a great business and want to continue.

“Over the last year, there have been at least 20 companies that have said: ‘Look we’re interested in Callcredit.’

“There was a winnowing process, but there were a lot of quality investors interested in us. We’ve been working over the last year to make sure we have the best home, and the best investor, to see us through the medium and long term

“They (GTCR) have just raised new funds, so in terms of firepower for new acquisition, that’s proven, and they’ve actually ring-fenced a pool of funds for us to look at internationally. In the UK, we’ve done well, but we’ve still only got 11 per cent market share. The UK will be a key focus for us over the next five to 10 years.

Advertisement

Hide AdAdvertisement

Hide Ad“We do want to grow our international footprint because our customers increasingly have international requirements, especially in this world of e-commerce and customers buying and expecting services remotely over the web.”

Callcredit employs around 1,000 staff, with 650 based in Leeds.

Mr McAndrew added: “We’re looking for about 50 new people, the majority in Leeds. During the course of this year, we’ll probably be taking on another 100 people. Again, a good majority of those will be in Leeds. Now that we’ve got increased investment power we’ll probably be expediting that process.”

Callcredit’s customers include payday lenders. In recent months, a number of commentators, including the Archbishop of Canterbury, Justin Welby, have called for tougher measures to regulate payday lenders.

Advertisement

Hide AdAdvertisement

Hide AdMr McAndrew said Callcredit was helping payday lenders to operate responsibly.

He added: “Around 10 per cent of our revenue comes from the payday lending or alternative lending space. All pay day lenders say ‘no’ to 80 to 85 per cent of consumers who apply for loans. They don’t accept everyone, and they use our information to try and ensure that they lend responsibly.

“What we’re all about as a business is helping businesses to lend responsibly. What you can see, from the growth of the sector, is that there is a significant demand from consumers for alternative finance. Certainly, post-2009, there was a real diminishing of non-prime lenders. So the pay day lenders and short term lenders have filled that gap. They will continue to evolve.

“The industry and the regulators will continue to reach a good place. The good thing about Callcredit is that with our technology we can change quickly.”

Advertisement

Hide AdAdvertisement

Hide AdCallcredit has not published an estimate for this year’s turnover.

Mr McAndrew said: ”Over the last couple of years, we’ve grown by about 20 per cent a year. I can see us doing something similar this year.”

GTCR managing director Collin Roche said: “We are delighted to partner with John McAndrew and the Callcredit management team. We believe that Callcredit is perfectly positioned to continue its success and growth within the rapidly evolving areas of consumer credit and data analytics.

“We believe that GTCR is ideally positioned to back Callcredit and its management team’s success by pursuing opportunities for strategic acquisitions and geographic expansion.”

Advertisement

Hide AdAdvertisement

Hide AdAdvisers involved in the deal included Paul Mann and Jonathan Jones, of Squire Sanders; Yunus Seedat and Susie Siddall, of Addleshaw Goddard; John Hughes and Chris Barnes, of KPMG; and Tim Simpson, of Park Place Corporate Finance.