Gas price cap may need to rise but shortage of goods will ease says Bank of England governor

While insisting it was too early to speculate on any movement on Government imposed limits that energy firms can charge consumers, Andrew Bailey said that the “forward curve” of trends in energy pricing may mean that Ministers have to increase the threshold on how much utility providers can charge households for energy.

Gas prices have been soaring during the past year, and were this week trading at about six times the levels they were at in January.

Advertisement

Hide AdAdvertisement

Hide AdDemand has rocketed as the world comes out of successive Covid-19 lockdowns and businesses try to step up their enterprises. However, production is lower and, owing to the weather being less windy over the summer, more gas was burned for electricity.

At the moment the price cap on energy bills is protecting around 14m households from shouldering the worst of the burden.

Speaking to The Yorkshire Post during a visit to Leeds, his first in person trip since assuming the role, Mr Bailey said: “The gas price issue which is the subject of the moment.

“Obviously we have the price cap system in the UK and the Government has made clear that the winter price cap is not going to change in terms of the input to our inflation. The question really becomes what is the price cap going to be next summer.”

Advertisement

Hide AdAdvertisement

Hide AdThe cap is expected to be reviewed early in the new year and the governor said it would be then that any decision to raise it would be made.

“A huge amount can happen between now and then so I am not going to speculate, but at the moment the forward curve would suggest that it would be higher so that would suggest inflation persistence, so transience would be longer.”

Energy costs are not the only pressure facing the economy, with consumers and businesses struggling to access certain goods and components, leading to a shortage of many essential household items.

However, Mr Bailey added that the current shortage of goods and services in the UK economy would not be permanent.

Advertisement

Hide AdAdvertisement

Hide AdHe said: “We think they will be transient because the underlying causes of them are mainly at the moment supply side shocks. There is good reason to think they will go away.”

When asked how long this period of transition would last, Mr Bailey replied: “There isn’t a fixed definition of that.”

Back in February, Mr Bailey had predicted a huge rise in consumer spending once lockdown restrictions eased, something he said he did not see ending any time soon, with households sitting on an estimated £200bn in additional savings

He said: “I don’t think it is over, decisions are being put on hold as Covid has hung around. Activity is coming up more, but it is still a live issue for the economy. We just need the supply side to cooperate, we do need things for them to buy.”

Advertisement

Hide AdAdvertisement

Hide AdMr Bailey’s visit to Leeds came just after the Government’s furlough scheme ended and on the same day that the £20 uplift in Universal Credit was removed.

He said the current labour market in Britain was difficult to read, adding there were “some very big moving parts at the moment”.

“I think there were more jobs on the furlough scheme right up to the end then we expected there would be,” he said.

“Unemployment is higher than it was pre-Covid, around 200,000 higher and inactivity is around 600,000. But then we have over a million vaccines advertised which is a record number. We don’t expect to see a pick up in unemployment at all. In many ways that would be a good story if we do get to see it.”

Advertisement

Hide AdAdvertisement

Hide AdMr Bailey took over the governor’s role from Mark Carney in March of last year, just days before the nation was plunged into the first lockdown to mitigate the spread of Covid-19.

He was also a key figure at the Bank of England during the financial crisis more than a decade ago, something he said gave him a mind-set when the economy was once again thrust into recession last spring.

“One of the big learnings I took was to act early,” he said. “It is easy to say in our line of work ‘well let’s just give it a bit longer and see what happens’, and that was not the right answer.

“The answer was we had to get in there early and in large-scale to tackle the problem. Certainly I took that experience from the financial crisis.”

Advertisement

Hide AdAdvertisement

Hide AdKey to this, he said, was dealing with the widespread meltdown seen in the financial markets in the run-up to, and following, the lockdowns.

“If that had gone on it would have been hugely damaging,” he added.

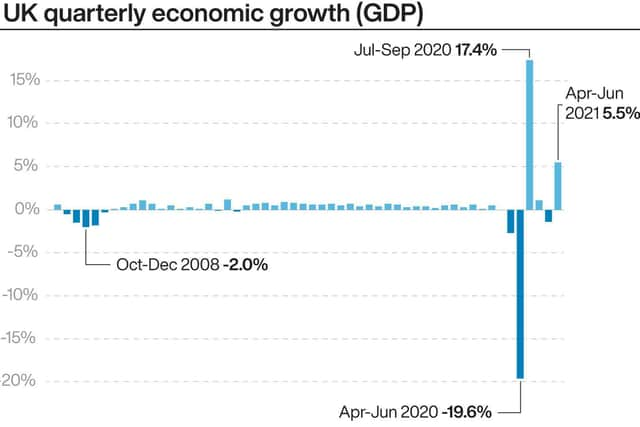

Despite the turmoil, Mr Bailey said there was plenty to be optimistic about, both in Yorkshire and nationwide, concerning the economic outlook. The UK economy contracted by a record 9.7 per cent in 2020 and, while GDP is still short of pre-pandemic levels, it grew by 5.5 per cent between April and June.

Mr Bailey attributed the performance demonstrated the resilience of Britain’s business community.

Advertisement

Hide AdAdvertisement

Hide AdHe said: “We have seen a recovery of the economy from the deep recession we had last Spring and early summer. We got through that period without damage on the scale that could easily have happened to employment, to incomes and to business.

“Despite everything that is going on, that is a good story as it means we have got an economy that has come through this very difficult period. Now, that is not over with.

“We talk about a bridge which in a sense forms a virtual bridge to get the economy over this and we are not there yet by any means.

"But it is a strong story and you see it in Yorkshire.”