Housing boom as Persimmon toasts £1.9bn payout

The York-based company, Britain’s largest housebuilder by market value, said it entered 2014 with a very strong forward order book and the early weeks of the spring selling season have been encouraging, with sales 22 per cent ahead of last year in the first eight weeks.

Persimmon has been boosted by Government schemes such as Help To Buy, which have freed up the mortgage market and lifted demand.

Advertisement

Hide AdAdvertisement

Hide AdPersimmon’s finance director Mike Killoran said the group is looking forward to another year of good sales growth in 2014.

“Three things have supported the industry,” he said.

“Firstly, there has been an improvement in risk appetite from mortgage lenders. We’ve seen a 30 per cent increase in mortgage approvals, which reflects that increase, particularly at the higher loan to value end.

“Secondly, we’ve received a boost from the first phase of Help To Buy, which has captured the imagination of the homebuying public.

“Thirdly, we’ve seen the return to the UK of more meaningful economic growth.”

Advertisement

Hide AdAdvertisement

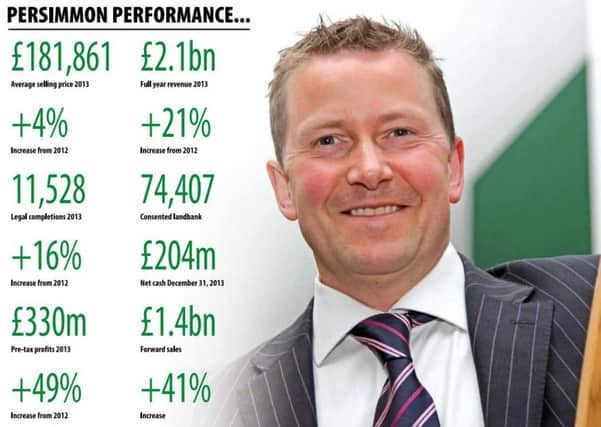

Hide AdPersimmon sold 11,528 homes in 2013, 16 per cent more than 2012 and the average selling price rose four per cent to £181,861.

The group said it expects a similar increase in sales volume in 2014 and it has the capacity to build 14,000-15,000 new homes a year.

Mr Killoran said the group saw very good growth in its Northern division.

“We built 4,500 new homes in the North last year, up 21 per cent on the previous year.

Advertisement

Hide AdAdvertisement

Hide Ad“The average selling price in the North is just over £150,000, which is down two per cent on the previous year as we have sold a greater number of smaller properties in the North,” he said.

This was not the case for the country as a whole, which saw more demand for larger homes.

“It’s due to the mobilisation of people who’ve been sat on the sideline.

“The general improvement in the mix allowed second and third-time movers to buy new property,” said Mr Killoran.

Advertisement

Hide AdAdvertisement

Hide AdSimon Usher, the director in charge of Persimmon Homes Yorkshire, said: “Customer demand has certainly increased in the region.

“We have built our success on responding to local demand and delivering the types of houses needed to meet the requirements of local people.

“The purchase of land is key to our future success and as a business we acquired 17,735 plots of new land across 130 high quality locations during 2013. We continue to work closely with local authorities to gain planning within the region to ensure we continue to meet the high demand from potential buyers.

“Help to Buy, the Government’s equity loan scheme, has undoubtedly helped some people get on to the property ladder or simply move up quicker than they anticipated.”

Advertisement

Hide AdAdvertisement

Hide AdOver the year Persimmon opened new developments in Retford and Selby and this year it has launched developments in Easingwold, Hull, North Hykeham and Selby and plans to open a further seven this year including new developments in Hornsea, Harworth, York and Don- caster.

Mr Killoran said the group has generated a lot of cash on the back of strong improvements in volumes and it has decided to bring forward a £1.9bn payout to shareholders.

The initial scheme was for payouts every two years between 2013 and 2020, with a final payment of 115p in 2021.

Mr Killoran said the company will pay out 70p per share on July 4, bringing forward part of the 2021 payment to top up the dividend of 10p announced in April last year.

Advertisement

Hide AdAdvertisement

Hide AdIt will also pay 95p per share next year and will pay shareholders at least 10p per share in 2016 and 2018.

Persimmon’s results follow bank lending figures showing that the number of mortgage approvals ran at a six-year high in Jan- uary.

The British Bankers’ Association (BBA) said 49,972 approvals for house purchase worth £8bn got the go-ahead last month – up six per cent on December and 57 per cent higher than a year earlier.

The Government ended the mortgage element of its Funding for Lending scheme offering banks cheap access to finance at the start of this year, but the market has remained buoyant amid ongoing cheer on the economy and after the launch of the UK-wide Help to Buy mortgage guarantee scheme last October, offering state-backed mortgages to credit-worthy first-time buyers and home movers with only a five per cent deposit saved.

Advertisement

Hide AdAdvertisement

Hide AdAnalyst Mark Hughes, at Panmure Gordon, described Persimmon’s figures as a “strong set of results” and said the acceleration of shareholder payments was “good news” for investors.

Analyst Gavin Jago, at Shore Capital, said: “This is a strong set of results, with a 16 per cent increase in legal completions and a four per cent increase in the average selling price to £181,000 driving a 21 per cent improvement in revenues to £2.1bn.”