HSBC in bid to get round cap on bank bonuses

Under new European Union rules that come into effect next year, bonuses will be limited to 100 per cent of a banker’s salary or 200 per cent if shareholders agree with the scheme.

Yesterday HSBC said it makes 80 per cent of its profits outside the EU in places where it has to compete against banks who can play their employees what they like.

Advertisement

Hide AdAdvertisement

Hide AdHSBC chairman Douglas Flint said: “We are talking to our shareholders about what actions we could take to protect our returns on capital in those markets outside the EU.”

One option is to significantly increase base salaries.

“We are very confident that we can come up with a remuneration structure which is in line with the Parliamentary Commission on Banking Standards’ recommendations and complies with CRD IV, but enables us to remain competitive,” said Mr Flint.

He was speaking yesterday as HSBC reported lower than expected earnings due to a slowdown in emerging markets.

Pre-tax profits rose 10 per cent in the first half of 2013 to £9.2bn thanks to a three-year cost-cutting plan and a fall in bad debts.

Advertisement

Hide AdAdvertisement

Hide AdHowever revenue fell by 12 per cent to £22.4bn, which was a bigger fall than expected.

Ian Gordon, analyst at Investec, said: “For all the worthy progress in terms of strategic repositioning, weak revenues driven by anaemic loan growth and a declining margin constrain financial progress and returns.” HSBC chief executive Stuart Gulliver has sold, or exited, 54 businesses and cut £2.6bn in annual costs.

“There has been a slowdown in faster-growing markets in recent quarters, even emerging markets go through business cycles,” said Mr Gulliver.

“But the reality is those markets continue to grow relatively quickly.”

Advertisement

Hide AdAdvertisement

Hide AdHSBC, Europe’s biggest bank by stock market value, has had a troubled time in Latin America and Mr Gulliver has sold and closed many businesses there, leaving its focus on Argentina, Brazil and Mexico.

It was given a record US fine last year for compliance failings in its Mexican operations, adding to pressure on Mr Gulliver to streamline.

HSBC’s Leeds-based internet and phone bank First Direct approved £1.8bn of new mortgages during the first half of 2013, helping 16,200 customers to buy their own homes.

Of these, 2,500 were first-time buyers getting on the mortgage ladder for the first time.

Advertisement

Hide AdAdvertisement

Hide AdFirst Direct did not split out how much it approved in new mortgages in the first half of 2012, but it approved £4.8bn for the whole of 2012, implying there has been a slowdown.

The Leeds-based bank, owned by HSBC, increased its customer numbers to £1.23m, up one per cent on last year.

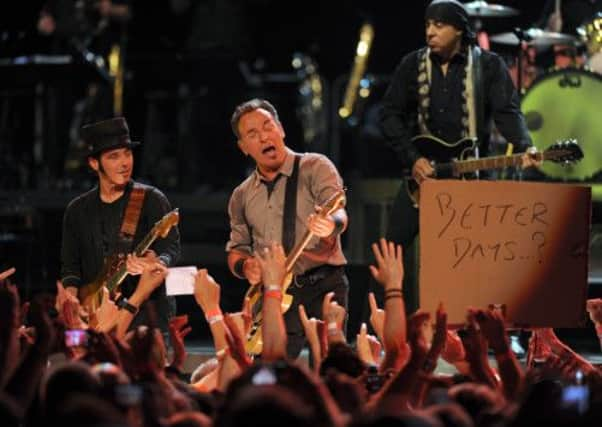

Earlier this year the bank announced its sponsorship of the state-of-the-art First Direct arena, which was opened by rock singer Bruce Springsteen last month, who performed to a capacity crowd of 13,500 in the new £60m venue.

The sponsorship is part of First Direct’s programme of supporting the communities where it works.

Advertisement

Hide AdAdvertisement

Hide AdIt is also designed to widen the bank’s appeal to a younger audience.

Tracy Garrad, head of First Direct, said: “The announcement has been well received by the people in the region as it has already attracted many big names to the venue.

“We can’t say as yet if there has been a pick-up in customers as it’s only just been launched and had Bruce Springsteen – however April this year was our biggest month for customer acquisition since 2006.”

Ms Garrad said that influencing factors could have been a reduction in paying in criteria from £1,500 to £1,000 and favourable reviews from money advice websites.

Advertisement

Hide AdAdvertisement

Hide AdFirst Direct does not report separate profit figures from parent company HSBC.

Earlier this year HSBC announced plans to cut annual costs by up to another £2bn and said it may axe a further 14,000 jobs globally as it strives to drive earnings and dividend growth in the face of muted revenue.

The bank said global employee numbers could fall to between 240,000 and 250,000 by 2016, from 254,000 when current disposals and announced cuts take effect.

It did not say where the additional cuts would be made, saying only they would be “spread quite thinly around the world”.

Advertisement

Hide AdAdvertisement

Hide AdThe HSBC banking group has approximately 5,500 office and branch-based staff across Yorkshire, including 2,000 in Leeds and 3,000 in Sheff- ield.

In Leeds, it has a call centre in Arlington plus internet and First Direct’s office in Stourton.

It also has four offices in Sheffield: Griffin House, The Balance and Hoyle Street which support the head office, plus a training centre at Milton House.

Arena nominated for top award

The First Direct Arena in Leeds city centre has been nominated for a major architectural award.

Advertisement

Hide AdAdvertisement

Hide AdThe arena has been shortlisted for The Structural Awards 2013, a prestigious international award which is hosted each year by The Institution of Structural Engineers.

The arena opened in spectacular style last month with a critically acclaimed performance by Bruce Springsteen and the E-Street Band.

The awards judges said: “The arena’s design is a great example of good engineering overcoming multiple challenges.”

The winner will be announced on November 15.