MOTLEY FOOL: The journey to becoming a better investor

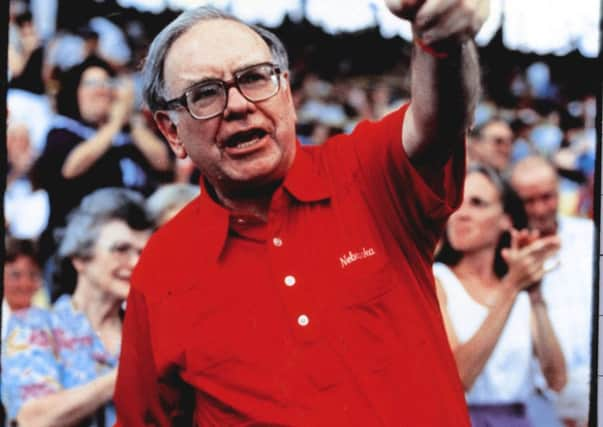

Buffett is famous for buying strong companies with powerful franchises like Coke and IBM, and holding them for decades. He’s also a value investor; he tries to bag a bargain price in relation to the fundamental value he sees in a company. And such is the Buffett mythology – and the octogenarian’s near-peerless record – it’s easy to believe he left the womb this way. Not so! In The Snowball, I discovered that Buffett was first a chart-following punter. He tried to guess the direction his next investment was headed not by reference to the company’s operations, but by looking at the zigs and zags on a price graph. Hallelujah. Buffett went through a clueless phase like the rest of us.

Early starter or late bloomer?

Admittedly, Buffett got started in the investing game very early. In fact, Buffett’s price-guessing approach was done and ditched before he’d left college. Remember at that time investing was a backwater pursuit, very different from now where websites, blogs, and bookshelves groan with advice on how to invest like, well, like Warren Buffett. Buffett was clearly a child prodigy. Most of us start much later, even today. Which means we’re older again before we find our investing groove.

Dodging the dotcom boom and bust

Advertisement

Hide AdAdvertisement

Hide AdPersonally, I began in my early 30s, which seemed at the time early but now seems stupidly late. On a brighter note, I’d been diligently saving for a decade before that, and back then you could get six or seven per cent on cash in the bank. So my 20s weren’t a dead loss, financially speaking. Better yet, being tardy meant I escaped the dotcom crash. Handy, because at the time as a technology journalist I had a ringside seat, and would probably have gone along for the ride like everyone else. Instead I learned the lessons from that momentous boom and bust without paying a penny in tuition fees. I was also able to pick up bargains in the aftermath in the form of discarded value shares and other too-cheap bits-and-bobs. But I’m getting ahead of myself How did I finally get started?

One terrible call with a silver lining

I’ve met several private investors who, like me, ended up putting the cash they’d saved for their first London home into shares because, well, I guess like me they’d also discovered they were value investors who could not bring themselves to pay for a bedsit in Peckham. Like these other contrarians, I decided London property was too expensive to risk my hard-saved cash on. To me, the supposedly wild stock market actually looked safer. So I decided to finally put all the investment reading I’d been doing (everything from Motley Fool’s articles and discussion board posts to classic books by Jim Slater and Peter Lynch) to work. Coincidentally, it was also the house price debate that led me to become an active member of the Fool, when I joined the arguments that raged on our property discussion boards. My debut post – saying London property was clearly overpriced and would surely crash – was one of the most recommended posts ever on the Fool at the time. That feedback gave me more encouragement I was on the right track than the trajectory of London property prices did… and indeed more encouragement than it should have done, because London prices have more than doubled since I called them grossly overvalued! Happily, investing in equities has proven more fruitful.

Learning to lose

It’s not been all smooth sailing, mind you – far from it. The early years threw up some steep learning experiences (which is what anyone who pushes on despite losing money must inevitably come to call them). For example, there was the small cap that turned out to be a fraud. I lost the lot. There was another company that was essentially driven out of business by negative publicity. I think I only lost most of my money with that one. Then there were the ‘value traps’ that meandered miserably downwards for seemingly aeons, teaching me that looking at the published investing metrics would only get me so far. Oh, and there was the financial crisis and previous bear market, too. That was fun! Of course there were also early successes, otherwise I doubt I would have stayed the course. And whether through luck or improving judgement, the successes are outweighing the failures as time goes on.

2-1 at half time

You’d hope it’d work that way, of course. You put in the time, learn the hard lessons, and so become a better investor. The stock market, though, is a mercurial opponent that invariably disappoints the complacent, and you can never discount the influence of good and bad luck. Also, plenty of research has shown that experienced and perhaps overconfident investors do worse than know-nothing investors, which is hardly what you see in alternative spheres, such as competitive tennis or brain surgery. That fact alone should humble anyone who enjoys a good run from their stock picking.

I did it my way

Advertisement

Hide AdAdvertisement

Hide AdIt wasn’t easy losing thousands of pounds with some of my earliest investments – and to be honest it’s not a cheerful experience now. I still get some calls very wrong. But in some ways the toughest thing has been to keep learning and developing my approach the challenge of investing. Most successful stock pickers eventually seem to find one way that works for them, and urge others to follow that path. But I seem to be more diversified in terms of both the companies I own in my portfolio, and the reasons that got them in there. Then again, perhaps I’m not so different. Warren Buffett actually shifted his style several times even after he ditched those charts and took value investing to heart. The master went from being a pure “Ben Graham”-style fundamentalist to giving weight to all sorts of qualitative factors. He has several times put money to work in sectors he’d previously berated. Buffett even once ran a hedge fund! To say I’d never compare myself to Warren Buffett is almost as laughable as actually making the comparison. Clearly, Buffett is one of a kind, both in terms of his investing nous and his results. But I do know that if Warren Buffett feels he has needed to continue to learn and evolve over the decades, then so must I.

THE MOTLEY FOOL

The Motley Fool provides investment research and commentary at Fool.co.uk

The company’s name was taken from Shakespeare, whose wise fools both instructed and amused, and could speak the truth to the king without getting their heads chopped off! The Fool has spent decades championing shareholder values and advocates tirelessly for the individual investor.

You can look forward to our fortnightly column every other Saturday here at The Yorkshire Post, or visit Fool.co.uk