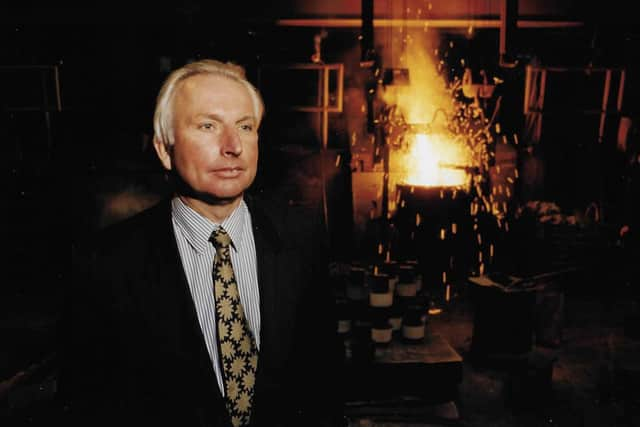

Sir Andrew Cook on 1990s Yorkshire steel takeover war: "It would have killed me if I had lost - literally"

This article contains affiliate links. We may earn a small commission on items purchased through this article, but that does not affect our editorial judgement.

When Sir Andrew Cook says he sees business as war, he means it.

Reflecting on the vicious fight to prevent his family steel company being lost to a hostile takeover bid - now the subject of a gripping new book by former Yorkshire Post business editor Bernard Ginns called Outcast: Cook Versus The City - Sir Andrew immediately reaches for a military analogy.

Advertisement

Hide AdAdvertisement

Hide AdNot only that, he says he believes that defeat would have been so crushing it would have resulted in his early death.

Speaking to The Yorkshire Post from Switzerland where he now lives, Sir Andrew explains of the process: “Think about Wellington at Waterloo. Whilst you are fighting a battle, you don’t really think about it beyond parrying every blow that comes at you. The long-term objective is to win but to win you have got to fight every time they come at you with whatever you have got.

“You have got to fend it off. Every time you face a cavalry charge, you have got to gun it down.

“Every time you face a broadside, you have got to respond. The bid fight was no different from that except it wasn’t live ammunition that was being fired at me, it was words and money. But what was at stake was still my life without a doubt.

Advertisement

Hide AdAdvertisement

Hide Ad“Afterwards I realised I was fighting for my life and it would have killed me if I had lost it. I mean that in a literal sense.”

He is revisiting the intense process of fending off a hostile takeover bid by rival firm Triplex Lloyd in the 1990s following the recent publication of Outcast, an authorised account that tells the story from Cook’s perspective but is very far from a hagiography with its frank portrayal of his domineering personality and strained relationship with his father.

Author Bernard Ginns left journalism to set up a communications consultancy in 2016, with Sir Andrew’s firm William Cook Holdings among his clients.

He says he knew Sir Andrew to be “a world away from the usual corporate types I would meet on a daily basis” from his dealings with him as a journalist - eventually leading onto the idea for the book.

Advertisement

Hide AdAdvertisement

Hide AdHe says: “During the lockdowns of 2020, I was doing some research work for the company when I came across volumes of press cuttings from the Triplex Lloyd hostile bid. It was a treasure trove of pre-digital national and regional coverage that documented the increasingly acrimonious battle. I suggested the story was ripe for retelling and would make a brilliant book. Andrew agreed and provided access to his archives, diaries and unpublished memoirs. Outcast is an authorised account although I retained editorial control throughout and consider it to be an even-handed portrayal of the bid and its central character, warts and all.”

The family company had been casting steel since 1883 after being founded by Sir Andrew’s great-great grandfather and it was in late 1996 when Triplex Lloyd launched their takeover attempt - a move Cook took as a personal assault.

The offer valued William Cook at just under £58m. The personal attacks began immediately with Triplex Lloyd chief executive claiming William Cook shareholders were “suffering from their management’s loss of ambition and its failure to pursue new growth opportunities successfully”.

The initial feeling in the financial press and amongst City analysts was that the bid would be likely to succeed, while questions raised about Cook’s autocratic management style in an era where corporate governance procedures were high on the agenda and greater oversight of company bosses was being increasingly demanded by shareholders with new City codes of conduct introduced.

Advertisement

Hide AdAdvertisement

Hide AdCook had made his opposition to the codes public, believing them to be “hasty and ill-considered” and making following regulations a higher priority than running a business effectively.

The tide started to turn when stock picker Terry Smith released research suggesting the company was worth double the Triplex offer. Triplex upped their offer to £72m but Cook had pulled together a larger £80m bid for a management buyout for taking the company private to present to shareholders with the help of Smith, who put him in touch with venture capitalists Electra Fleming.

Cook says: “This was my life’s work and it risked being destroyed.

“There are career chairmen who see their job as getting the best deal for shareholders but not putting their own money at stake.

“They’ll talk to the City and get another job afterwards.

Advertisement

Hide AdAdvertisement

Hide Ad“None of that psyche works with me. I knew it had to be me who got the best price. That was the only way of saving the whole thing by getting that down on the table.”

An increasingly bitter briefing war played out in the papers, with Cook facing a series of sleaze allegations, including the improper use of company funds to pay for a nanny and an all-expenses paid sailing holiday in the Caribbean for Cook and colleagues.

Against the advice of his PR team, Cook faced the allegations by speaking to the media himself - admitting while there was some truth to what was being said, it was not the full story.

“They were more gross distortions or half-truths than complete lies. There were things about nannies being employed by the company and yachts and so on.

Advertisement

Hide AdAdvertisement

Hide Ad“We reimbursed the company with the full cost of any salary every month.

“The yacht thing was with two of my directors for what you might call a team bonding session.

“It was no big deal and I told the truth and it all fizzled out. I flew too close to the sun and I admitted that.”

What was described as a ‘Houdini act’ worked with Triplex ultimately walking away in February 1997 - allowing the Cook deal to go through.

Advertisement

Hide AdAdvertisement

Hide AdHe says today Terry Smith was vital to ensuring his success.

“He put out research which showed the bid was undervalued and that meant the share price never dropped below the bid price. Had it done so, the bidder could have hoovered up a lot of shares. That allowed me to get my financing together. I had a very good relationship with Barclays Bank and the Bank of Scotland.

“I essentially had £40m of buy-in finance, I was short of about £30m. I put in everything I had got which was a meagre £5m and Terry put me in touch with Electra who warmed to my approach and my story.

“They brought in Andrew Jackson of Intermediate Capital. These chaps got on a bus with me and went around all the factories showing genuine interest in the opportunity. Without them I would have never got the money together. The whole thing ended up being a £100m deal and everybody got their money back in the end.”

Advertisement

Hide AdAdvertisement

Hide AdBut the victory came at a cost with Cook forced into having new owners who wanted their money back and a new board of directors to answer to.

That summer, the Triplex Lloyd chief executive departed and in January 1998, the firm was sold itself to Doncasters Group for £200m.

But final victory came to Cook in 2004 when he succeeded in getting Electra Fleming to sell their stake back to him - returning the firm to full family control. That remains the ownership position to this day, with Cook still in post and his son William a director.

Cook says: “That was the crowning achievement, that was worth waiting for and working towards.”

Advertisement

Hide AdAdvertisement

Hide AdHe says he still believes his approach to running a company is superior than other alternatives. “If you believe business is a war, which I do, you have to have a Supreme Commander. The current mode is to have a split command, with a chairman and a chief executive, various committees and non-execs. But that hasn’t stopped some pretty spectacular frauds and collapses. The only thing it has stopped is those blokes going to jail.”

He says looking back on the battle today, it has even greater significance for him than it did at the time.

“When you look back on it afterwards and the longer the time passes, the more you see it in perspective. That was the fight of my life without a doubt. I survived it and I literally do go down on my knees and thank God for his help in that battle. I’m here today living a comfortable life with a company with no debt and it was all thanks to winning that bid.

“It didn’t make everything right overnight. It took another 10 years to continue the recovery. But if I hadn’t won that bid, I wouldn’t be alive now.”

Outcast: Cook Versus The City by Bernard Ginns is available to purchase via Amazon now.