TCS protects itself from high street turmoil

The Leeds-based firm said it has also been boosted by the decision to turn the Merrion Centre into a mixed-use asset rather than a traditional shopping mall. High street retailers have suffered the worst of the consumer downturn as shoppers rein in spending.

The firm, which has properties in Leeds, Manchester, Scotland and London, said trading in the year to June 30 has been positive, with significant progress made in updating, improving and recycling its property portfolio.

Advertisement

Hide AdAdvertisement

Hide AdSince the half year results reported in February, the firm has completed purchases in Manchester and Chiswick, London, and the sale of a retail property in Edinburgh. In addition, the company has renewed or extended all of its bank facilities.

The group said that overall trading was in line with the board’s expectations. Like-for-like passing rent rose 4.1 per cent and overall occupancy slipped from 99 per cent to 95 per cent.

The performance includes the increased rent from Leeds City Council in Merrion House and the impact of the vacant unit in Milngavie, Scotland which it is currently sub-dividing, which was the cause of the occupancy reduction. Excluding these two items, underlying like-for-likel passing rent rose 1.9 per cent.

TCS said it has made good progress with its Leeds and Manchester developments. The two cities combined make up 73 per cent of the group’s portfolio, based on the December 2017 valuation. TCS said they remain core to the strategy and growth prospects of the business.

Advertisement

Hide AdAdvertisement

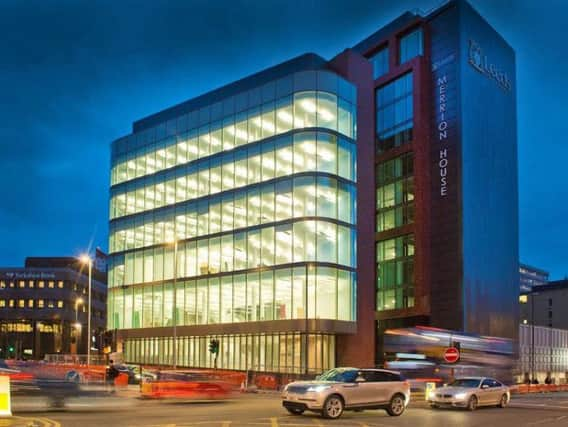

Hide AdThe group said that over the past 12 months, it has made significant progress in strengthening its regional presence. In Leeds, it said the Merrion Centre is now a “true mixed-use asset“ and with the re-development of Merrion House and the ibis Styles hotel, the dependence on traditional “mall” retail income has reduced to less than a quarter of the total.

The company has completed the development and occupation of Merrion House with its joint venture partner and tenant Leeds City Council. The firm’s share of the annual rent is now £1.7m. TCS is also in the process of entering into a joint venture with Leeds City Council for construction of an apart-hotel with retail units on George Street, alongside Leeds City Market and Victoria Gate.

Edward Ziff, TCS chairman and chief executive, said: “We continue to make good progress against our strategic aims. The activity of the last 12 months reflects our strategy of continually improving the quality and sector mix of our portfolio for the long-term, whilst ensuring we have a balanced regional portfolio.

“Turning the Merrion Centre into a true mixed-use asset and continuing to lower our exposure to retail has helped ensure we have been protected from the worst of the turmoil on the high street.

Advertisement

Hide AdAdvertisement

Hide Ad“The opportunity for growth that sits within our development pipeline, combined with the recent updating and renewal of our banking facilities put us in a great position to focus on the next phase of our growth.”

Analyst David Brockton at Liberum said: “Town Centre Securities’ full year trading update confirms progress across the business driving rental growth, repositioning assets towards better uses and delivering the group’s significant development schemes.

“We believe the value inherent in the group’s asset management and development activity will continue to support growth and warrants a higher valuation.”

In the last six months TCS has extended or renewed all its bank debt facilities.

Advertisement

Hide AdAdvertisement

Hide AdIts £35m facility with Lloyds has been renewed for three years with an option to extend by two years with margins consistent with the previous facility.

Commenting on the renewal, Tom Cross, relationship director for Lloyd Bank Commercial Real Estate, said: “Town Centre Securities is one of the North’s leading listed property companies, which we’ve been proud to support for many years. Our funding will continue to help it drive its growth, job creating investment and development plans going forward.”

The group’s £35m facility with Handelsbanken has been renewed for five years with a small increase in margin reflecting the longer facility term.

TCS has exercised an option to extend its £33m RBS facility by a further year to 2021 at the same margin.

As a result, the company said it now has certainty over its debt position for the next three to five years, along with improved and more flexible terms in all facilities.