Why Merrion Centre owner Town Centre Securities is eyeing up residential sector as it moves away from its retail roots

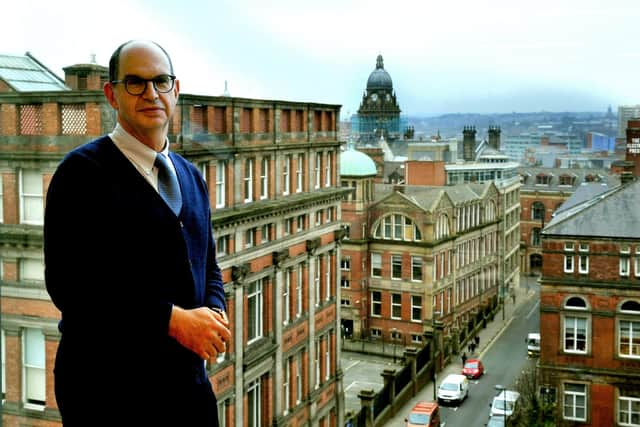

Edward Ziff, chairman and chief executive of the Leeds-headquartered property firm, told The Yorkshire Post that the residential sector was an ‘obvious’ place to turn to for growth as the company continues to diversify from its retail roots.

“Residential will certainly be more important to us than it has been,” he said.

Advertisement

Hide AdAdvertisement

Hide Ad"We need a place to invest our money that will perform as well as retail performed for us and I think residential, because there’s a huge shortage, will continue to see rental values increase. So that’s an obvious place for us to go.”

The listed investment, development, hotel and car parking operator, which owns the Merrion Centre in Leeds, reported a "resilient" half-year performance amid "ongoing macro-economic challenges".

The company, which has a portfolio spanning Leeds, Manchester, Scotland, and London, reported a statutory loss before tax of £9.7m for the six months ended December 31, 2023, compared to a loss of £19.1m in 2022 as a result of a 4.4 per cent like-for-like decline in its portfolio value.

"I feel ok about them (the half-year results),” said Mr Ziff. “It’s a hard economic environment to be operating in as a property company.”

Advertisement

Hide AdAdvertisement

Hide AdHe added: “We feel seven or eight out of 10 in terms of how things are going. It could be better but it could be a whole lot worse.”

Mr Ziff said that the company has spent the last five years reducing its debt and getting to a place of financial security. “We were aware that we had too much debt and we decided to grasp the nettle,” he said. “It was hard to come to terms with selling properties where the cash flow net after debt was significantly earnings enhancing but we decided that some of those properties were going to cause us more difficulty as time moved on.”

The company has now completed its debt reduction strategy and sold a lot of its retail property. Only about 25 per cent of its property portfolio is now retail compared to 55 per cent five years ago, Mr Ziff said.

During the six months to December 31, the group acquired a city centre car park investment property leased to NCP in Wellington Street, Sheffield for £1.5m, and secured two new car park management agreements, increasing the number of car parks operated under its CitiPark brand to 20.

Advertisement

Hide AdAdvertisement

Hide AdIn December, plans were submitted for student accommodation at the Merrion Centre in Leeds. The application includes a 1,110-bed purpose-built scheme based on the redevelopment of Wade House and the adjacent 100MC site

Looking ahead, Mr Ziff said: “We are continuing to look for opportunities to start building our income stream again, whether that’s through development or through purchasing existing investment properties that we can then manage and work on to improve.”

He added: “I don’t think we will be particularly acquisitive over the second half of the year. We’re continuing to look for interesting opportunities and if we find them we’ll buy them. We’ve got a lot of unused bank facilities which are available to us to use.

"However, building prices are beginning to stabilise and with inflation becoming more predictable I can see us wanting to proceed with developments more aggressively than we might have done say six or 12 months ago.”