Labour promises no income tax rises for those earning less than £80,000

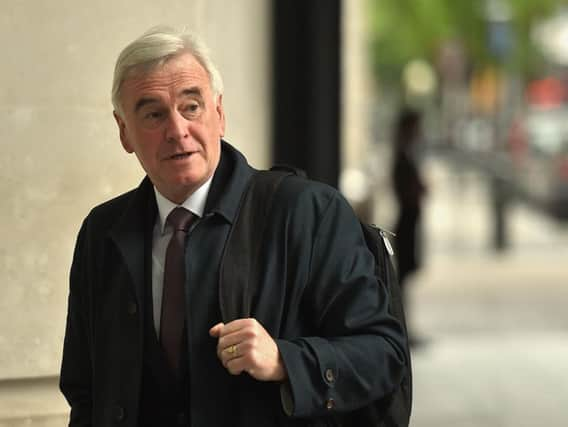

Mr McDonnell said the pledge would mean only the top 5% of earners would face personal tax hikes to help pay for extra spending on public services, while his "personal tax guarantee" would protect 95% of workers from increases.

He said the Labour manifesto for the June 8 General Election will also include a promise of no rises in personal national insurance contributions (NICs) or VAT over the course of the five-year parliament, due to end in 2022.

Advertisement

Hide AdAdvertisement

Hide AdThe move forms part of a Labour bid to position itself as the party of low and middle-income workers, as it fights Conservatives for the support of a social group which has suffered stagnating wages since the financial crash.

Speculation is rife that Prime Minister Theresa May is preparing to ditch predecessor David Cameron's 2015 pledge not to raise rates of income tax, national insurance or VAT until 2020, after Chancellor Philip Hammond said last month he would like "more flexibility" on the issue.

Mr Hammond was forced by the 2015 pledge to dump planned reforms to NICs in the Budget.

Detailing the plans in a speech in London on Sunday, Mr McDonnell is expected to say Labour is now the only party committed to not raising taxes on middle and low-earners.

Advertisement

Hide AdAdvertisement

Hide AdHe will spell out his economic vision for a richer Britain in what he terms a "big deal to upgrade the economy".

"If Labour is elected next month we will guarantee that for the next five years there will be no tax rises for income taxpayers earning less than £80,000 a year, no hikes in VAT, and no changes in your National Insurance Contributions either," he will say.

"The Labour Party is now the party of low taxes for middle and low earners, while the Tories are the party of tax handouts for the super-rich and big corporations.

"That is why every time Theresa May and the Tories are asked whether they are planning tax increases if they are re-elected on June 8, they run and hide."

Advertisement

Hide AdAdvertisement

Hide AdMr McDonnell will accuse Mrs May of refusing to take part in TV debates in order to avoid being put on the spot over tax.

"They are so determined not to be questioned on their plans, the Prime Minister refuses to take part in any TV debates and will only visit workplaces if there are no workers there, just her own party's activists," he will say.

"The Tories are hoping that the British people can be kept in the dark about what the tax increases they are planning will mean for those on middle and low incomes, who have had to bear the brunt of seven years of austerity."

Conservative chief secretary to the Treasury David Gauke said: "Jeremy Corbyn will have to raise taxes because his nonsensical economic ideas don't add up and he'll make a mess of the Brexit negotiations."

Advertisement

Hide AdAdvertisement

Hide AdLiberal Democrat Treasury spokeswoman Baroness Kramer said: "Labour's so-called tax pledges aren't worth the paper they're written on, given their inability to form a proper opposition, let alone a government.. Labour has a spending list as long as your arm yet does not explain how to pay for it."

The chief executive of the TaxPayers' Alliance pressure group, John O'Connell, noted the proposed £80,000 cut-off for protection from tax hikes would kick in just above the level of MPs' £76,000 salary.

He said the pledge appeared to leave open the possibility of hikes in employers' NICs, increases in VAT outside the standard rate or tax on income from rental and dividends.

"Pledging to not increase taxes sounds good but unfortunately there are gaping holes in these proposals that will leave taxpayers and small businesses worried," said Mr O'Connell.

Advertisement

Hide AdAdvertisement

Hide AdThe director general of the free-market thinktank, the Institute of Economic Affairs, Mark Littlewood, said increasing income tax for the top 5% of earners would be "a disincentive to investment and enterprise" and could undermine economic growth and reduce tax revenues.