Treasury should fund 'Dragons' Den'-style deals with green energy companies, think tank suggests

Research by the IPPR think tank said that the country risks falling behind in the global race to achieve a net zero economy without investment in new technologies.

This could see “Dragon’s Den”-style deals where the Government would fund companies in return for a share of their profits in order to push through green energy projects.

Advertisement

Hide AdAdvertisement

Hide AdIt called for the creation of a new public body that should take “strategic stakes” in companies to secure future jobs.

This comes as the Joe Biden administration in the US marked the first anniversary of its Inflation Reduction Act, aimed at boosting domestic investment in clean energy, infrastructure and jobs, which has seen the EU respond with its own Green Deal Industrial Plan.

In March The Yorkshire Post revealed that Labour was working on its own version of the Inflation Reduction Act with members of the team which wrote up the landmark bill in the US.

Ed Miliband, the party’s former leader and current shadow climate change secretary, said at the time: “We need a government that needs to do a British version of the Inflation Reduction Act to generate these jobs, and jobs in Yorkshire.”

Advertisement

Hide AdAdvertisement

Hide AdIt came after Rachel Reeves, Labour’s shadow chancellor, told Labour’s conference in Liverpool that her party would use a “National Wealth Fund” which would use an initial £8 billion investment to help rebuild British industry.

The Government has resisted pressure to react to the US and EU investment in green energy, with critics describing the generous subsidies on offer by the economic powerhouses as a race to the bottom which Britain cannot afford to compete with.

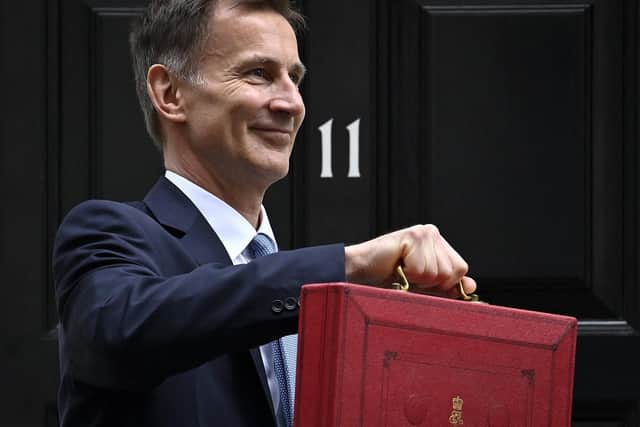

Jeremy Hunt, the Chancellor has described the US president’s policy as a “very real competitive threat” but argued that America was “coming from behind” in its investment in green energy and Net Zero, something he said Mr Biden’s predecessor, Donald Trump, was “not remotely interested in”.

He later suggested that this was not a competition in which the UK would be entering, adding: "We are not going toe-to-toe with our friends and allies in some distortive global subsidy race.

Advertisement

Hide AdAdvertisement

Hide Ad“With the threat of protectionism creeping its way back into the world economy, the long-term solution is not subsidy but security.”

The IPPR report argued that a National Investment Fund (NIF) would provide investment for projects that would encourage private companies to make “strategic investments that they would not otherwise make.”

“The NIF would provide equity finance to firms, supplying funding in return for becoming a part-owner of the business and sharing in its success and future profits – analogous to the type of investment offered on the BBC’s Dragon’s Den,” the think tank said.

Researchers suggested that the initial funding would be provided by the Treasury, as well as further taxes on what it calls “excess profits” and revenues from fossil fuels.

Advertisement

Hide AdAdvertisement

Hide AdSimone Gasperin, IPPR Associate Fellow, said: “The National Investment Fund is a policy proposal for our time.

“The UK needs to finance and coordinate strategic industrial policy projects that will deliver a net zero transition through economic prosperity and inclusion.

“The cost of inaction on people’s livelihoods will be too high, while there are huge opportunities to be captured by the government co-investing with private companies.”

George Dibb, Head of the IPPR Centre for Economic Justice said: “For the UK to hit net-zero our households and businesses will need to buy new green products – from electric cars to heat pumps.

Advertisement

Hide AdAdvertisement

Hide Ad“We have a choice: do we want to make those products in the UK with all the jobs and prosperity that come with green manufacturing, or do we want to import them from abroad?

“The USA and EU are making major investments to secure the manufacturing and technologies of tomorrow, and it's time the UK stepped up.

“Our proposal for a National Investment Fund is a practical way for the UK government to crowd-in private sector investment by strategically supporting companies and taking a share in their future success.”