Yorkshire Water remains ‘under the spotlight’ amid concerns it is 'overexposed to debt'

Robert Goodwill issued the warning after he grilled Thames Water bosses about its financial issues, when he chaired an Environment, Food and Rural Affairs Committee hearing in Parliament this week.

Earlier this month, some feared Thames Water was on the brink of collapse as it has been struggling to service a £14bn debt pile following interest rate rises.

Advertisement

Hide AdAdvertisement

Hide AdBut the company has assured customers that it has a plan to shore up its finances and was recently backed by a £750m shareholder investment.

Mr Goodwill said: “The spotlight is on water companies like Yorkshire Water. They need to fix their balance sheets and not be so reliant on debt.

“I think they've all allowed themselves to be overexposed to debt and more importantly, overexposed to repayments where the interest rates are linked to inflation.”

Water companies, which collectively hold £60bn of debt, claim they need to borrow to invest in their networks, but there are concerns that some are not generating enough profit to pay off their loans and prioritising dividends over infrastructure investment.

Advertisement

Hide AdAdvertisement

Hide AdYorkshire Water, which reported net debt of £5.6bn in 2021/22, recently announced that shareholders have injected £500m into the business and it had raised a further £700m by issuing bonds in the UK.

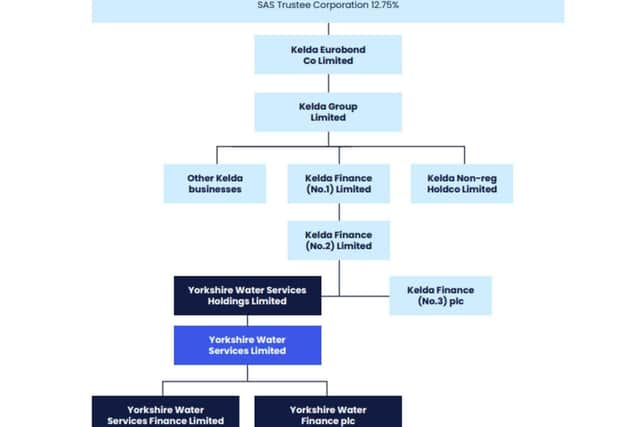

The utility firm and other companies in the Kelda Group regularly issue bonds – a form of loan repaid with interest – to raise money.

Its subsidary, Yorkshire Water Finance Plc, has issued £390m worth of Eurobonds, and $180m of Eurobonds in US dollars, on the International Stock Exchange in the Channel Islands since 2018.

Its parent company, Kelda Eurobond Co Ltd, has issued more than £1.9bn of bonds on the same market.

Advertisement

Hide AdAdvertisement

Hide AdThe legal loophole means tax-free interest payments can be sent to anyone who has invested in a Eurobond.

In 2013, Parliament’s Public Accounts Committee warned that multinational companies were exploiting the loophole to lend money to their UK subsidiaries via low-tax jurisdictions.

They then deducted the interest payments from profits recorded in the UK, to cut their tax bill.

But Kelda Group, run by an international consortium of investors, has said its companies are registered in the UK and “do not use artificial tax avoidance schemes or tax havens to reduce our tax liabilities”.

Advertisement

Hide AdAdvertisement

Hide AdA spokeswoman said they issued bonds in the Channel Islands for “cost reasons on admin” and not because they recieve different “tax treatment”.

She also said the £1.9bn of Eurobonds issued by Kelda Eurobond Co Ltd have been “converted into equity by our shareholders”.

Yorkshire Water spent £281.9m interest payments in 2021/22, including £264m on interest linked to inter-company loans.

It also paid dividends of £52.6m to the Jersey-based Kelda Holdings, even though it did not record a profit (loss of £368.6m).

Advertisement

Hide AdAdvertisement

Hide AdLast year, Ofwat launched an investigation after it raised concerns about two loans Yorkshire Water had provided Kelda Eurobond Co Limited. It was owed more than £940m in total, but the investigation was closed after it set out a plan to recover the money by March 2027.

The regulator has also stated it is monitoring Yorkshire Water’s gearing level, which is a measure of a company’s financial risk.

Last year, it stood at 72 per cent – higher than the average of 68.5 per cent. A higher level indicates a higher proportion of debt compared with its equity

A Yorkshire Water spokeswoman said: “We finance our capital investment programme that funds improvements in the service customers see by reinvesting profits, funds from shareholders and through borrowing.

Advertisement

Hide AdAdvertisement

Hide Ad"We are repaying intercompany loans and as we’ve had capital injections from our shareholders this has meant that we’ve been able to repay a substantial amount already.”

According to Ofwat, investment in the water industry has roughly doubled since privatisation in 1989, and companies spent around £6bn a year on upgrading their infrastructure between 2015 and 2020.

But they also paid out £57bn in dividends to shareholders and parent companies between 1991 and 2019.