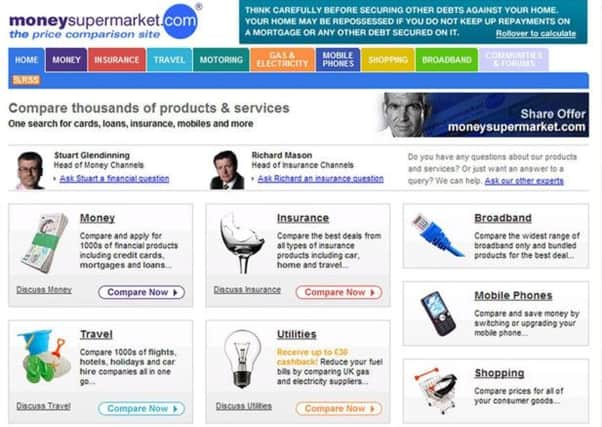

City watchdog says comparison websites fail to give full picture

However, sites covering car and household insurance are failing to give consumers a true picture of the products they buy, the City regulator has said.

The Financial Conduct Authority (FCA) accused some sites of focusing on the price of a policy without clearly explaining “crucial features” such as levels of cover and the excess a customer might have to pay in the event of a claim.

Advertisement

Hide AdAdvertisement

Hide AdThe regulator added that some sites were associated with a larger insurance group or broker but did not disclose potential conflicts of interest, which is against its rules.

It has asked the industry to take action on the specific areas identified in the review and urged consumers to consider that not all products are the same and the cheapest product may not always be the best for their needs.

The FCA reviewed 14 websites between December and April, but did not identify which they were.

It said an estimated one-third of consumers buy their motor insurance policies through such sites.

Advertisement

Hide AdAdvertisement

Hide AdBy failing to provide clear information, the FCA said the websites are increasing the risk that consumers may buy products without understanding key features such as level of cover or excess levels and purely focus on the price.

A few websites did provide detailed information about the policies they reviewed, but the level of clarity in the market “varied significantly”.

The watchdog concluded that consumers were not being given the right information to help them make decisions.

FCA director of supervision Clive Adamson said: “Price comparison websites have increased in popularity among consumers, with an estimated one-third of consumers buying their motor insurance policy through them.

Advertisement

Hide AdAdvertisement

Hide Ad“However, our review found that they were not meeting our requirements in delivering fair and consistent outcomes for consumers.

“We also found, through our consumer research, that consumers had a number of misconceptions about the services they provided.

“We expect price comparison websites to take on board the findings of the review.

“It is also important for consumers to understand that not all products are the same and the cheapest product may not always be the best for their needs.”

Advertisement

Hide AdAdvertisement

Hide AdAmongst the smallprint on the website of Gocompare.com, customers are informed that it is 50 per cent owned by Esure, an insurance company.

Similarly another site, Confused.com, is owned by Admiral Insurance – a fact stated at the bottom of the comparison websites homepage..

However, the FCA found no evidence that such firms had profited as a result of their potentially conflicting ownership.

The FCA said it expects the price comparison websites mentioned in its report to “take on board the findings” it had published.

The FCA will be providing individual feedback to the websites involved, and will be asking them to take action on specific areas where they are failing to meet its expectations.