Yorkshire has joint-highest Help to Buy ISAs uptake in the country - but benefit to rural home owners is limited

Help to Buy Individual Savings Accounts (ISAs) give first-time buyers a 25 per cent Treasury bonus on cash they save for a mortgage deposit, worth up to £3,000.

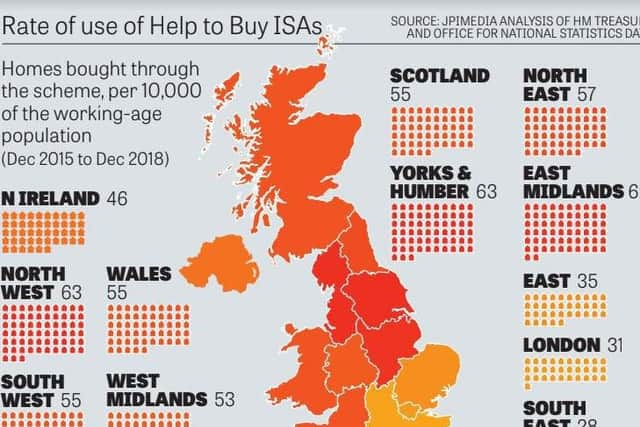

-> Andrew Vine: Rural idyll in Yorkshire is blighted by exodus of young families as housing crisis deepensSince their introduction in 2015, they have seen double the rate of use in the North of England than in the pricier areas of London and the South East, analysis by the JPIMedia data unit reveals today.

Advertisement

Hide AdAdvertisement

Hide AdPolly Neate, chief executive of Shelter, said that "piecemeal schemes like Help to Buy aren’t the answer" to "totally unaffordable to private rent or buy", adding that "we need to see ambitious investment in social housing if we’re going to tackle the housing crisis".

In Yorkshire and the Humber, the number of homes bought through the scheme per 10,000 of the working-age population between December 2015 and December 2018 was 63 - the joint highest figure along with the North West.

-> Rural communities ‘ignored and underrated’ says damning Lords reportOn a constituency level, three areas of Leeds - Morley and Outwood, Pudsey, and Leeds West - registered in the top ten for places using the scheme.

And analysis of local authorities showed Selby was fourth highest council area.

Advertisement

Hide AdAdvertisement

Hide AdHowever, the scheme had a limited effect in several areas of North Yorkshire, where house prices are generally higher.

The scheme can only be used to buy a home worth up to £250,000, or £450,000 in the capital.

Richmondshire, which covers large parts of the Yorkshire Dales, was the local authority area with the lowest take-up of Help to Buy ISAs anywhere in the region.

Although the average house price was below the level imposed by the scheme, at £208,265.67, only 113 homes were bought under the offer.

Advertisement

Hide AdAdvertisement

Hide AdHambleton and Craven also had a below-average uptake, alongside Bradford in West Yorkshire.

-> Campaign to Protect Rural England says there is a '133-year waiting list' for rural social housingMore than 500 homes were bought in Harrogate - above the average at 53.3 per 10,000 of the population - but the price limit was not in line with average prices in the area at £271,018.27.

House prices in York, too, are higher than the cap at £257,913.08.

Some £24,899,395 was paid out in bonuses to 28,276 first-time buyers in the region.

Advertisement

Hide AdAdvertisement

Hide AdThere were 62 homes bought through Help to Buy ISAs for every 10,000 people of working age in the North of England more generally, analysis shows.

But in London and the South-East, this rate was just 29.

There are also tight restrictions on how much savers can put away each month, with the resulting Government bonus worth on average just £899 per person.

James Chidgey, relationship manager for the Mortgage Advice Bureau, said it was not surprising that Help to Buy ISAs had seen less use in areas with more expensive housing, describing them as “fairly inflexible and quite limited from a savings perspective”.

But he said those saving for a first home could instead consider the Lifetime ISA.

Advertisement

Hide AdAdvertisement

Hide AdIt also gives a 25 per cent Government bonus on savings for a first home, but offers greater flexibility in some respects.

This includes being able to save more per year and being able to buy a house worth up to £450,000 anywhere in the UK.

Mr Chidgey said the Lifetime ISA’s bonus could be worth up to £1,000 each year.

He said: “If two people are buying together and have separate ISAs, this bonus will be even more significant, and in the space of a few years may mean a couple could have a meaningful deposit for a property.

Advertisement

Hide AdAdvertisement

Hide Ad“It’s important to note that the Lifetime ISA is geared towards people who aren’t in a hurry to purchase their first property as you must have held the account for at least 12 months to receive the 25 per cent bonus.”

A spokesman for the Treasury said: “The Help to Buy and Lifetime ISAs have been hugely popular with first-time buyers.

“More than 218,000 property completions have been supported through the Help to Buy ISA and 330,000 Lifetime ISA accounts have been opened since its introduction, helping more people to get on the property ladder and save for later in life.

“These ISAs, like all tax policy, are kept under constant review.”

Advertisement

Hide AdAdvertisement

Hide AdIn June, the National Audit Office criticised another branch of the Government’s Help to Buy initiative, which provides equity loans for first-time buyers purchasing new-build houses.

Its report said take-up had “been low in less affordable areas” and that many of those using the scheme would have been able to buy a home anyway.