Revealed: these are the top 20 property hotspots and coldspots of 2021

Taunton in Somerset has been identified as the UK's top house price hotspot with property values increasing at more than three times the national average.

House prices in Taunton have increased by more than a fifth (21.8%) in the past year, compared to a 6.2% increase across the general UK, Halifax said.

Advertisement

Hide AdAdvertisement

Hide AdA place with a range of independent shops and is surrounded by attractive countryside including the Quantock Hills, Taunton's average house price rose by £56,546 to £315,759.

Chippenham, Wiltshire, a town with good links to the M4 and has rural surroundings, was also featured in the house hotspot benefitting from the "race for space" among buyers, with the biggest increase in house prices in cash terms.

Prices rose to an average of £381,181, marking an increase of £58,322 since 2020.

London did not appear on the top 20 hotspots list. The area of London with the largest growth was Enfiled, where the average house price rose 6.8%, to £512,135.

Advertisement

Hide AdAdvertisement

Hide AdHalifax managing director Russell Galley said: "As the county town of Somerset, this year's house price winner, Taunton, has a lot to offer home-buyers with its high quality of life and great transport links to major towns and cities across the South West.

"Like Taunton, many of the areas that saw the biggest house price growth over the last year enjoy a combination of greater affordability and space compared to nearby cities.

“Places like Bolton, Newark, Bradford and Hamilton – where there are a broad range of property types and settings – all offer significantly better value than their more metropolitan neighbours.”

Mr Galley added: “This is perhaps most clearly shown in the UK’s capital. It is rare that no London boroughs appear amongst the areas of highest house price growth but that is the case in 2021.

Advertisement

Hide AdAdvertisement

Hide Ad“This shift echoes what we have seen from home-buyers over the last year – less focus on major cities and more demand in the suburbs and further afield.”

The hotspots

The top 20 hotspots with the highest growth in the average house price over the past year, according to Halifax, with the average house price now and the one-year change in cash and percentage terms:

1. Taunton, South West, £315,759, £56,546, 21.8%2. Newark, East Midlands, £280,934, £46,732, 20.0%3. Rochdale, North West, £206,098, £32,123, 18.5%4. Chippenham, South West, £381,181, £58,322, 18.1%5. Braintree, South East, £356,216, £54,236, 18.0%6. Widnes, North West, £222,876, £33,628, 17.8%7. Motherwell, Scotland, £177,118, £26,103, 17.3%8. Bolton, North West, £212,671, £30,818, 16.9%9. Hereford, West Midlands, £306,872, £44,336, 16.9%10. Walsall, West Midlands, £230,972, £31,614, 15.9%11. Bradford, Yorkshire and the Humber, £170,684, £23,323, 15.8%12. Swansea, Wales, £211,590, £28,360, 15.5%13. Kettering, East Midlands, £285,103, £36,783, 14.8%14. Maidstone, South East, £370,964, £47,756, 14.8%15. Newton Abbot, South West, £326,623, £42,014, 14.8%16. Spalding, East Midlands, £264,668, £33,703, 14.6%17. Wirral, North West, £276,042, £34,936, 14.5%18. Scunthorpe, Yorkshire and the Humber, £176,186, £21,986, 14.3%19. Doncaster, Yorkshire and the Humber, £201,824, £25,096, 14.2%20. Hamilton, Scotland, £159,176, £19,225, 13.7%

The coldspots

The 20 coldspots with the lowest growth in average house prices, according to Halifax’s figures:

Advertisement

Hide AdAdvertisement

Hide Ad1. Westminster, London, £738,088, minus £54,809, minus 6.9%2. Airdrie, Scotland, £150,874, minus £6,023, minus 3.8%3. Hammersmith and Fulham, London, £716,541, minus £24,525, minus 3.3%4. Coatbridge, Scotland, £145,880, minus £3,435, minus 2.3%5. Islington, London, £716,554, minus £11,368, minus 1.6%6. Kirkcaldy, Scotland, £157,663, £1,774, 1.1%7. Oxford, South East, £482,893, £5,808, 1.2%8. Croydon, London, £436,441, £6,502, 1.5%9. Inverness, Scotland, £198,672, £3,137, 1.6%10. Cambridge, East Anglia, £473,790, £8,600, 1.8%11. Dartford, South East, £353,714, £6,616, 1.9%12. Gravesend, South East, £356,196, £8,830, 2.5%13. Stockton-on-Tees, North East, £190,736, £4,739, 2.5%14. Waltham Cross, South East, £414,071, £10,863, 2.7%15. Glenrothes, Scotland, £151,945, £4,695, 3.2%16. Bexley, London, £416,390, £14,444, 3.6%17. Waltham Forest, London, £530,176, £20,733, 4.1%18. Havering, London, £428,012, £16,927, 4.1%19. Sutton, London, £481,265, £19,529, 4.2%20. Rochester, South East, £325,974, £13,499, 4.3%

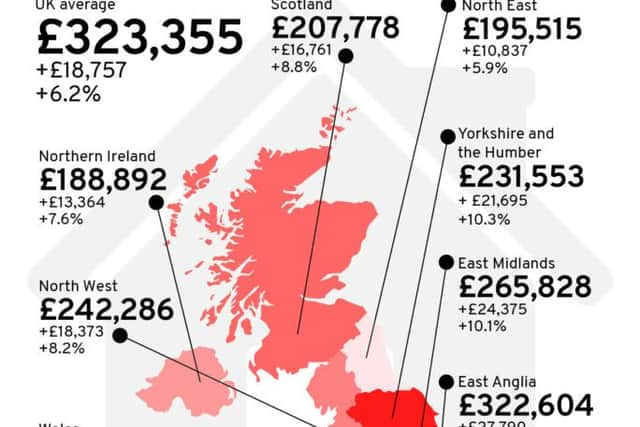

Price changes across the four nations

Price changes in Scotland, Wales, Northern Ireland and in England’s regions in 2021 as well as across the UK generally, according to Halifax, with the average price now followed by the one-year increase or decrease in cash and percentage terms:

Wales, £231,134, £28,454, 14.0%Yorkshire and the Humber, £231,553, £21,695, 10.3%East Midlands, £265,828, £24,375, 10.1%East Anglia, £322,604, £27,790, 9.4%Scotland, £207,778, £16,761, 8.8%North West, £242,286, £18,373, 8.2%Northern Ireland, £188,892, £13,364, 7.6%South West, £329,110, £22,608, 7.4%West Midlands, £266,659, £15,185, 6.0%North East, £195,515, £10,837, 5.9%South East, £420,042, £11,651, 2.9%London, £554,684, minus £3,588, minus 0.6%UK average, £323,355, £18,757, 6.2%

A version of this article originally appeared on NationalWorld.com