Motley Fool: One simple way you can invest better

No book you can read to become Warren Buffett overnight. No ‘system’ for getting rich quick.

But what if there was one simple thing you could do, right now, which could dramatically improve your returns?

Advertisement

Hide AdAdvertisement

Hide AdIn my opinion, the key to successful investing isn’t found in adopting complex, automated systems, or intricate chart-reading techniques.

Instead, I think it’s often the simplest of changes that could help many ordinary investors make more money from the stock market.

Some are so simple, actually, that they might seem blindingly obvious, but you’d be amazed at how powerful tips such as these can be.

Let me share one with you today, which in my view, could dramatically improve your returns: increase your time horizon.

Advertisement

Hide AdAdvertisement

Hide AdAccording to recent research, the average investor holds stocks for a median time period of just six months.

In fact, many ‘day traders’ hold stocks for mere minutes before selling out.

But when we think about investing here at The Motley Fool, we view shares as part-ownership stakes in living, breathing businesses.

And while stock prices gyrate from one number to the next as the days and weeks go by, the actual value of companies, generally, don’t change much at all.

Advertisement

Hide AdAdvertisement

Hide AdBusinesses – the good ones, which we try to invest in – tend to become more valuable over periods measured in years and decades.

And I think that some investors are really missing out on the huge benefits that can come from simply taking a longer time horizon with their investments.

It’s a huge edge that private investors have over fund managers, who might fear for their jobs if their portfolios suffered a bad quarter.

You aren’t constrained by the same pressures to “beat the benchmark” every month.

Advertisement

Hide AdAdvertisement

Hide AdYou can be patient – something that many professional investors cannot be.

This, in my mind, is where many fund managers fall short – and fail to justify their expensive fees.

And this isn’t to mention the phenomenal power of compound interest.

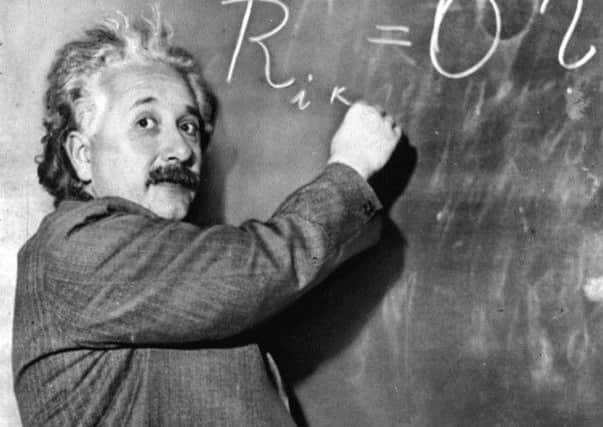

The longer you’re willing to invest for, the better chance you’ll have of benefiting from the remarkable wealth-building forces of long-term compounded returns. (There’s a reason Einstein called it the “eighth wonder of the world”!)

Advertisement

Hide AdAdvertisement

Hide AdShort-term minded investors are lucky if they even hold a stock for long enough to receive a dividend – and if they do, they probably hardly think about it.

But over the long-run, dividends – especially if you reinvest them, as part of a smart investing strategy – can become overwhelmingly important to your returns.

To use a vanilla example, take the FTSE 100 since the start of the millennium. Since the start of January 2000, the FTSE 100 index is down 5 per cent.

Hard to believe, isn’t it? That over such a long period of time, buying and holding a FTSE 100 tracker – and spending all the dividends – has produced a negative result.

Advertisement

Hide AdAdvertisement

Hide AdBut with dividends taken into account, and reinvested, you’d be showing a 56 per cent gain, even if you’d bought near the top of the tech bubble!

Put in perspective, a £100,000 investment would’ve been worth just £95,000 if dividends were ignored, but £156,000 if those dividends were reinvested in the market.

That’s a huge difference, and it’s the wonder of compounding that we have to thank for it.

The longer time period you look at, generally, the less your returns will have to do with bull or bear markets, or short-term macroeconomic issues, and the more they will come down to the businesses you part-own, through your shares.

Advertisement

Hide AdAdvertisement

Hide AdAt The Motley Fool, our poorly kept secret is this: we never make recommendations based on which shares we think will go up or down next week or next month. That’s because we don’t have that sort of skill.

Indeed, we think most commentators would be better off throwing darts at the Financial Times, trying to guess price directions over that timeframe.

That might sound like an odd thing to admit, but nonetheless, I hope you will appreciate it’s the honest truth.

Instead, we aim to help our member community enjoy market-beating returns by helping them to invest for the long-term in the highest-calibre businesses. And as those businesses grow, and become more valuable, we will share in the wealth they create.

Advertisement

Hide AdAdvertisement

Hide AdSo if you’re looking for an easy way to improve your returns, my simple tip is this:

Make your average holding period as long as possible.

We’re also firm advocates of dividend-paying shares here at the Fool, and if dividend growth features in your investing criteria, then I highly recommend this special free report for income investors like you, which we’ve named Five Shares You Can Retire On.

It’s completely complimentary for all Yorkshire Post readers, and is available at fool.co.uk/retire.