Why the chairman of Xeros in Rotherham has compared the trajectory of its shares price to Amazon's

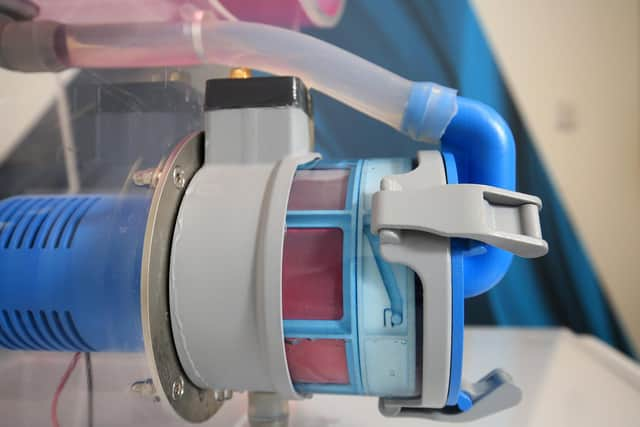

Xeros, which creates technology that reduces the impact of clothing on the planet such as microfibre filters for washing machines, saw its revenue increase by 23.1 per cent to £500,000 for the year ended December 31, 2021.

While its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) loss reduced by 7.1 per cent to £6.3m.

Advertisement

Hide AdAdvertisement

Hide AdKlaas de Boer, chairman of Xeros, said that it had been a year of "significant progress" in embedding Xeros' technologies into product lines of key licensing partners.

Just last week, Xeros announced a licensing agreement for its XFilter filtration technology with Hanning Elektro-Werke.

Under the terms of the ten year, non-exclusive agreement, Hanning will manufacture and sell filters incorporating Xeros' proprietary XFilter technology.

Mr de Boer believes that the company's share price doesn't reflect the progress it has made over the last 12 months.

Advertisement

Hide AdAdvertisement

Hide AdHe said: "In Amazon's 2000 Annual Report, Jeff Bezos mused about the total disconnect between the progress of Amazon's business and the trajectory of its share price. Today I observe the same at Xeros.

"Amazon's share price was down 80 per cent year-on-year, whereas the business had made very significant progress on all main metrics. Today, Xeros' shares are showing a similar trend, yet the company has made tremendous progress over the past 12 months.

"The analogy with Amazon is, however, far from perfect. Amazon was able to communicate quantifiable financial and commercial metrics, whereas, in the case of Xeros, most of the progress, although substantial, is less quantifiable, and we are not in a position to communicate specifics yet."

Long term trends "remain very favourable" for Xeros with France having legislated for mandatory in-machine filtration devices from 2025 and the UK preparing similar legislation. The EU and US is expected to follow suit.

Advertisement

Hide AdAdvertisement

Hide AdThe ecological footprint of the fashion and apparel industry is also coming under increasing public scrutiny with Xeros having developed more sustainable denim finishing technology.

However, the nearer term external environment remains "very challenging and unpredictable" for the firm with Covid continuing to disrupt operations in China, supply chains being stretched and rampant inflation.

Mark Nichols, CEO of Xeros, said: "2021 was a year of mixed fortunes for Xeros with Covid related lockdowns delaying the commercial progress of our existing licensees in contrast with the rapid development of prospective licenses of our filtration technology.

"Encouragingly, our South Asian partners are now free of lockdowns but not so our Chinese partner. Both regions continue to suffer major supply chain shortages and long lead times.

"Thus, our licensing revenues are behind where we planned them to be but importantly our prospects are unchanged in terms of achieving wide geographic take-up of all our technologies."

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.