Harry Fairhead: Do local councillors deserve their allowances '“ or not?

There are massive variations in the amounts that councillors receive in allowances across the country. Before the 1990s, there was no basic allowance so representing your local area was done out of community spirit. Doubtless this still exists today, but questions have to be asked when allowances and tax bills are going up while services are being cut.

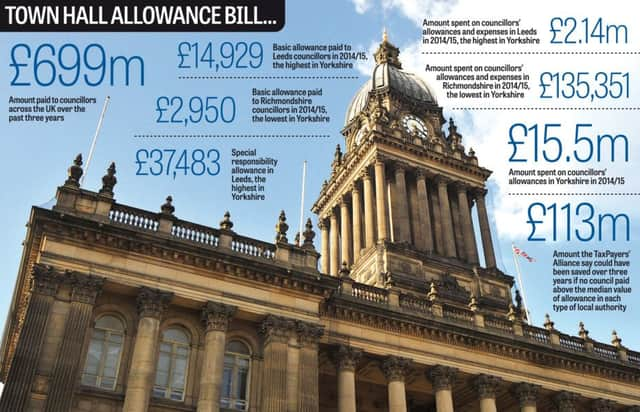

For example, it is unclear why Bolsover should pay a basic allowance (the standard amount for all councillors) of over £9,900 but Richmondshire in Yorkshire only offers just short of £3,000.

Advertisement

Hide AdAdvertisement

Hide AdUndoubtedly different types of council in different areas will require different levels of engagement and effort but the discrepancy across the country seems larger than one might expect.

This variation adds up to cost taxpayers a lot of money that could either be left in their pockets or spent on delivering front line services.

If no council paid above the median in each type of authority, at least £113m could have been saved. In those terms it becomes quite hard to justify some of the pay packets we have found.

This alone would be worrying, but we also found that many councils have increased the basic allowance over the past three years. At the same time, average wages and prices have barely increased, making it very difficult to justify hiking councillor pay.

Advertisement

Hide AdAdvertisement

Hide AdIf an allowance was compensation enough to do the job in 2012, there seems little reason to increase it. In spite of this, in the past three years, the basic rate of allowances has risen in over 200 councils.

Our research found that some councils have raised the basic allowance a lot since 2012-13 – over 80 per cent in the case of Waverley Council and over 40 per cent in Swale. Arguably these councils were bringing their basic allowance more in line with other councils as the 2012-13 figure was relatively low.

But some, such as Lincolnshire, rewarded their councillors relatively well in 2012 (just over £8,000) which subsequently rose by 23 per cent to £10,100 by 2014-15.

So in some cases there are serious question why the allowance has risen so much – especially as funding pressures mean services are being squeezed and that many areas face council tax rises.

Advertisement

Hide AdAdvertisement

Hide AdAnd remember that council tax has risen by 58 per cent on average in real terms over the past 20 years; in most cases the burden now is greater than ever, so councils should be very careful how they spend our money.

Perhaps the most remarkable finding was the £54,769 special responsibility allowance given to the leader of the Royal Borough of Kensington and Chelsea. These additional sums are given to councillors who perform additional tasks such as leading the council or its opposition. In contrast, sums around £15,000 were found across the country.

Clearly being the leader of a council is an important responsibility, but an allowance of more than twice the UK average seems egregious for what is not supposed to be a full-time job. And this £55,000 sum is on top of the basic allowance which the leader would also have received.

All of this boils down to one very simple fact: over the past three years the nation’s councillors cost local taxpayers £699m. Whatever your view on councillor pay, this is a very large sum taken from taxpayers that hasn’t gone towards delivering services, fixing the roads or collecting the bins.

Advertisement

Hide AdAdvertisement

Hide AdShould allowances be scrapped? Absolutely not. But while councils are having to make savings and services are being squeezed, is it appropriate to give councillors an inflation-busting raise?

Transparency and scrutiny is vital. Armed with the facts, local taxpayers can make a better case when they demand for reform or improvements in services.

Equally, where councils are delivering services efficiently, keeping council tax low and looking after the local areas well they can be applauded.

Allowances are just one thing that councils spend taxpayers’ money on but it is vital that these costs are kept low in order that the tax burden can be kept down and so money can go towards services.

This is what people expect when they hand over their council tax, and so it is what councils should focus on.

Harry Fairhead is Policy Analyst at the TaxPayers’ Alliance.