This includes adult social care and parish precepts, but does not take into account the £150 council tax rebate that will be provided to households in Bands A to D by the Government to help with rising energy prices.

The average 3.5 per cent rise for Band D properties in 2022/23 is below the 4.4 per cent rise in 2021/22 and is also the lowest year-on-year increase since 2016/17.

A full list of council tax levels for each local authority in England has also been published by the Government.

It shows that the average council tax for a Band D property, including parish precepts where appropriate, has fallen year on year in just one local authority in Yorkshire Selby, however when parish precepts are excluded, it hasn't fallen in any local Yorkshire authorities.

Across England, it has also fallen in Mansfield, South Ribble and Wandsworth, although when parish precepts are excluded, it has only fallen in Broadland and Wandsworth.

Those living in district council areas will pay a much lower sum than those living in unitary authority areas, but are also required to pay council tax towards the county council.

It means for example someone living in a Band D property in Hambleton will pay £166 to the district council, but also £1,467 to North Yorkshire County Council.

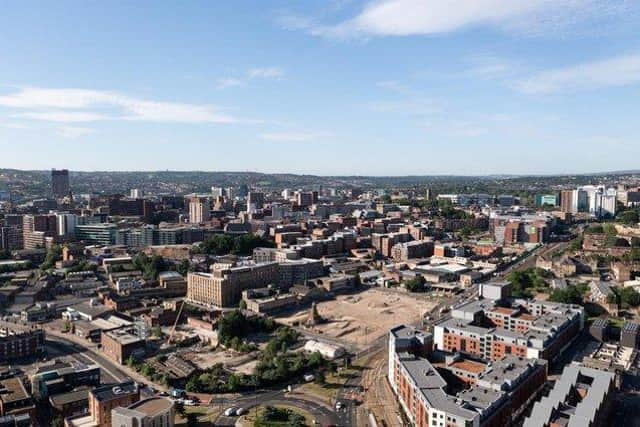

1. Sheffield

The average cost of council tax for a Band D property in Sheffield is £1,758, up 2.98 per cent compared to 2021/22.

2. Rotherham

The average cost of council tax for a Band D property in Rotherham is £1,734, up 4.48 per cent compared to 2021/22.

3. Kirklees

The average cost of council tax for a Band D property in Kirklees is £1,704, up 3.01 per cent compared to 2021/22.

4. Calderdale

The average cost of council tax for a Band D property in Calderdale is £1,687, up 3.01 per cent compared to 2021/22.