Beauty and lifestyle firm THG sees ‘acceleration’ in revenue growth

The group saw a jump in revenue of 4.5 per cent to £455.4m, up from a 1.1 per cent jump in the final quarter of last year. The group has now seen revenue growth in the past five consecutive quarters.

THG added that the lastest figure showed its strongest revenue growth since the second quarter of 2022.

Advertisement

Hide AdAdvertisement

Hide AdTHG is made up of THG Beauty, THG Nutrition and THG Ingenuity. The firm controls brands including Myprotein, Look Fantastic and Cult Beauty.

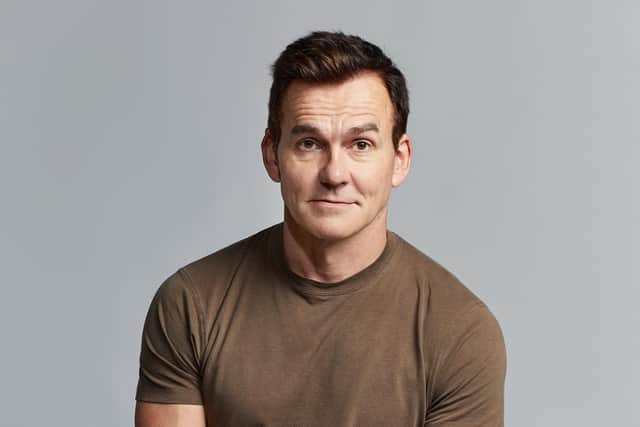

Matthew Moulding, CEO of THG, said: “Following the Group’s return to revenue growth in Q4 2023, it’s pleasing to report an acceleration in Q1, which is testament to the hard work and dedication of our people, who’ve remained focused on the task in hand despite the tough macro-economic backdrop.”

THG said that its Myprotein brand continues to be the “fastest growing sports nutrition brand across UK retailers”.

The first quarter of the year saw Myprotein distributed across sports nutrition and vitamins ranges in Asda, Boots and Tesco. This also followed a rebrand of Myprotein, which the group described as the “biggest in its 20 year history”.

Advertisement

Hide AdAdvertisement

Hide AdMr Moulding added: "The response to the Myprotein elevation rebrand has been fantastic. While these changes naturally impact short term revenues as old and new branded products are swapped out, the strong positive response from online consumers and offline retail partners alike underpins confidence once full product availability is restored."

Beauty was standout performer for the group, with 11.1 per cent growth overall, and even faster in UK.

Mr Moulding added: “The Q1 performance of our largest business THG Beauty, is especially encouraging. The operating model changes made throughout 2023, including focusing on more profitable territories and customers, temporarily impacted growth for much of last year, however, since Q4, we are seeing tangible benefits from these actions.

“This is reflected in THG Beauty’s loyalty membership reaching 2.3m people at the end of Q1, less than two years after launch."

Advertisement

Hide AdAdvertisement

Hide AdThe group said it would maintain its guidance for the 2024 financial year, with a focus on revenue growth, margin progression and cash generation. THG added that it expects revenue growth to continue to increase between two and five per cent in the first half of the year.

Over the past year, the group has increased its use of AI and automation, leading to reduced distribution costs.

These changes meant that adjusted distribution costs for the firm substantially reduced year-on-year to 13.2 per cent of revenue, down from 15.5 per cent in 2022.

Mr Moulding added: “It’s clear that the accelerated infrastructure investments made during 2019-2022, specifically into our fulfilment network and tech capabilities, are playing a significant part in delivering competitive advantage.

Advertisement

Hide AdAdvertisement

Hide Ad“With this major capex program behind us, these investments will continue delivering meaningful savings, which accelerate further as new Ingenuity partners are onboarded.”

THG’s Ingenuity arm saw monthly recurring revenue continue to build in March, with a 26.3 per cent jump. This followed a 14.7 per cent jump in revenue in December of 2023.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.