Yorkshire’s savers are lagging behind

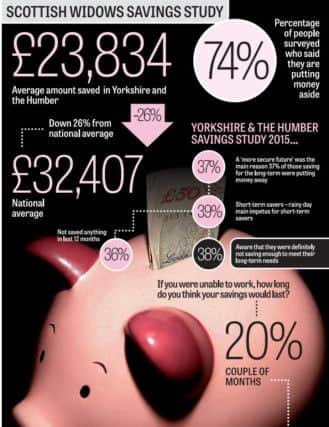

The poll, by Scottish Widows, also showed that one in three of those questioned in the region, 36 per cent, had not saved anything in the last 12 months, compared to just over a quarter nationally.

And over a third, 38 per cent, said they were aware that they were definitely not saving enough to meet their long-term needs.

Advertisement

Hide AdAdvertisement

Hide AdHowever, the pensions company said the national picture marked a “watershed year”, with more people putting money aside - up from 63 per cent in 2010, to 74 per cent. The average amount that people have in short and long term savings across the UK is also increasing, and stands at £32,407, marking a 7 per cent or £2,232 year-on-year increase.

But in Yorkshire and the Humber the figure is just £23,834 - a drop of more than a quarter. People living in the south east of England were found to have the highest amount saved, £43,229.

The report said the reasons behind saving had also changed, with more people choosing purely on long-term saving. In Yorkshire and the Humber, 37 per cent of those saving for the long-term said that providing for a “more secure future” was the main reason for putting money away, and the “rainy day impetus” was spurring on 39 per cent of short-term savers.

David Lascelles, savings expert at Scottish Widows, said: “It has been a watershed year in the savings landscape and the study reflects to some extent the effect that landmark changes have had on people’s mind set.

Advertisement

Hide AdAdvertisement

Hide Ad“Greater flexibility on savings vehicles, including Isas and pensions as well as reforms to how savings can be passed on, provide more incentives to put money away for the longer term.

“The increase in long-term savers suggests more people understand the need to prepare for their financial future.”

The study also revealed worrying statistics on how families in Yorkshire would cope if the breadwinner was unable to work.

One in five said their savings would only last a couple of months, while 16 per cent said their savings would last less than a month.

Advertisement

Hide AdAdvertisement

Hide AdThis comes after the charity Shelter warned in December that high housing costs were leaving families “teetering on a financial knife-edge”, with one in every 139 households in Yorkshire and the Humber is at risk of losing their home.

Scottish Widows also warned that upcoming pension changes, to be introduced in April, should prompt people to take “a realistic look” at their finances.

It said 24 per cent of people questioned in the region expected to have a shortfall in their pension, savings and investments in meeting their retirement income needs, and almost half, 49 per cent, admitted to not adequately preparing for retirement.

Scottish Widows retirement director Stuart Paton-Evans said: “For many people there is still a lack of understanding and certainty about what the changes actually mean and how they may affect their individual circumstances, and we must collectively ensure that people avoid rushing in and make the wrong decision as a result.”